What Is a Spiff in Sales? Definition, Benefits, and Best Practices

What Is a Spiff in Sales? Definition, Benefits, and Best Practices

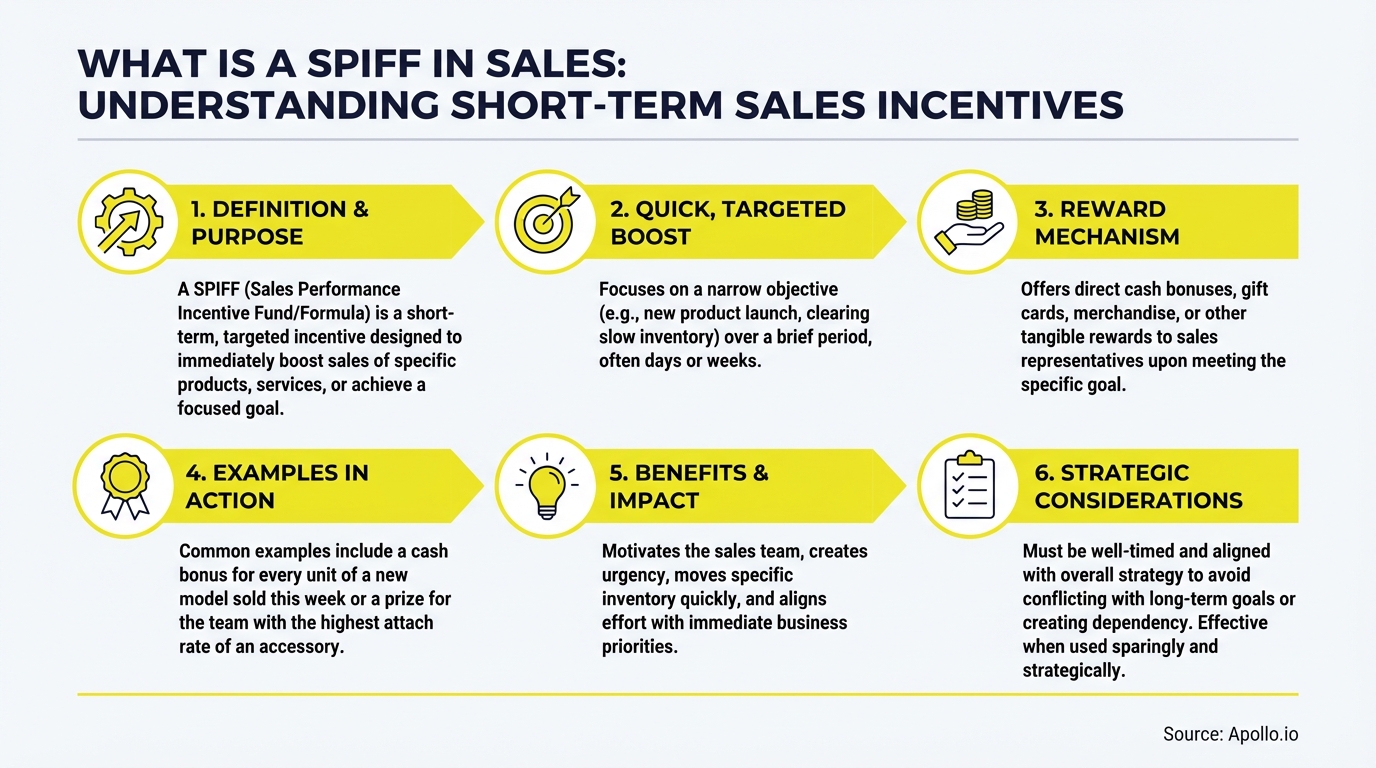

Sales incentive programs drive short-term performance spikes, but they rarely build sustainable momentum. A spiff is a short-term sales incentive that rewards reps for hitting specific targets like closing deals on new products or signing contracts before quarter-end. While spiffs create urgency and boost immediate results, they work best as part of a comprehensive sales strategy that balances quick wins with long-term engagement.

Apollo Eliminates 4+ Hours Of Daily Research

Tired of spending hours hunting for verified contact info? Apollo delivers 224M+ contacts with 96% email accuracy instantly. Join 550K+ companies who turned research time into selling time.

Start Free with Apollo →Key Takeaways

- Spiffs are temporary bonuses that reward specific sales behaviors, typically lasting days to months

- Research shows spiff-only strategies deliver 1% revenue growth vs 12% with integrated incentive programs

- Effective spiff programs require clear rules, transparent tracking, and integration with broader performance management

- Sales leaders are shifting from spiff-dependent models to holistic incentive systems powered by AI automation

- Modern sales platforms track spiff performance alongside pipeline metrics for complete visibility

What Is a Spiff in Sales?

A spiff (Sales Performance Incentive Fund or Special Performance Incentive for Field Personnel) is a short-term bonus that rewards sales reps for achieving specific objectives beyond their standard commission structure. Unlike base commissions tied to overall quota attainment, spiffs target precise behaviors like selling particular products, closing deals in specific territories, or hitting milestones within tight timeframes.

Spiffs typically take three forms: cash bonuses, gift cards, or experiential rewards like trips. The incentive amount ranges from $50 for small wins to $5,000+ for major deal closures.

Sales leaders deploy spiffs strategically to clear inventory, launch new products, or accelerate end-of-quarter pipeline conversion.

How Do Spiffs Work in Sales Teams?

Spiffs operate as overlay incentives that sit on top of existing compensation plans. Sales managers announce the program with clear eligibility criteria, reward amounts, and deadlines.

Reps who meet the specified conditions receive their spiff payout, usually within 30-60 days of achievement.

Implementation follows a four-step process:

- Define objectives: Identify the specific behavior you want to incentivize (new product sales, competitive wins, expansion deals)

- Set parameters: Establish payout amounts, eligibility rules, time limits, and verification requirements

- Communicate clearly: Announce the program through team meetings, email, and sales enablement platforms

- Track and pay: Monitor performance in real-time and process payouts promptly to maintain trust

Need better visibility into which incentives drive actual pipeline? Track deal progress and team performance in one unified platform with Apollo.

Why Do Sales Leaders Use Spiffs?

Sales leaders deploy spiffs to create focused urgency around strategic priorities. When executed properly, spiffs accelerate specific outcomes that standard commission structures don't address quickly enough.

They work particularly well for product launches, competitive displacement campaigns, and end-of-period pushes.

Common use cases include:

- New product adoption: Drive early traction for launches by rewarding first deals closed

- Market expansion: Incentivize entry into new territories or verticals with higher payouts

- Competitive wins: Offer bonuses for displacing specific competitors in head-to-head deals

- Pipeline acceleration: Push stalled opportunities forward with time-limited closing incentives

- Upsell focus: Reward cross-sell and expansion revenue from existing accounts

According to market research data, the sales compensation software market is projected to reach $7,413.9 million by 2033, reflecting growing investment in sophisticated incentive management systems that go beyond simple spiff tracking.

Turn Forecast Guesswork Into Revenue Certainty

Struggling to forecast when your pipeline lacks real-time visibility? Apollo delivers live deal insights and intent signals that make revenue planning predictable. Built-In increased win rates 10% with Apollo's scoring and guidance.

Start Free with Apollo →What Are the Risks of Spiff-Only Strategies?

Relying too heavily on spiffs creates significant long-term challenges. Data from Engagement Strategies Media shows that when one company shifted from an integrated incentive program back to spiff-driven compensation in 2024, revenue growth dropped from 12% to just 1%, while direct marketing ROI fell to 3%.

The research revealed three critical failure patterns:

- Engagement collapse: Engagement scores dropped from 0.85 during holistic programs to 0.77 under spiff-only models

- Training abandonment: Training completions plummeted from 1,462 to just 75 when spiffs became the primary motivator

- Short-term thinking: Reps focused exclusively on spiff-eligible activities while neglecting long-term account development

For Account Executives managing complex deals, spiff overuse creates perverse incentives. Reps cherry-pick easy wins instead of pursuing strategic accounts.

They pressure customers into premature decisions. They ignore relationship-building activities that don't trigger immediate payouts.

How Should Sales Leaders Integrate Spiffs with Broader Incentive Programs?

The most effective approach treats spiffs as tactical tools within a comprehensive Sales Performance Management (SPM) strategy. This means balancing short-term spiffs with long-term development programs, skill-building initiatives, and career progression incentives.

Modern sales organizations are consolidating their incentive tech stack. Instead of managing spiffs in spreadsheets, commissions in one platform, and performance tracking in another, forward-thinking teams unify everything in a single system.

As the Predictable Revenue team noted after consolidating tools: "We reduced the complexity of three tools into one."

Best practices for integration:

- Cap spiff earnings: Limit spiff payouts to 10-15% of total on-target earnings to prevent over-reliance

- Align with strategy: Ensure spiff objectives support quarterly business goals and RevOps priorities

- Rotate programs: Change spiff focus every 30-90 days to maintain engagement without creating dependency

- Track holistically: Monitor spiff impact alongside pipeline health, deal velocity, and customer retention metrics

- Combine with training: Pair spiffs with enablement programs that build skills beyond short-term behaviors

Struggling to track which incentives actually drive revenue? Unify your sales data and incentive tracking with Apollo's go-to-market platform.

How Do SDRs and AEs Use Spiffs Differently?

Spiff programs must account for role-specific responsibilities. SDRs and BDRs typically receive spiffs for booking qualified meetings, sourcing pipeline from new accounts, or penetrating target industries.

These incentives range from $25-$100 per achievement and reset monthly.

Account Executives face different spiff structures tied to closed revenue. AE spiffs reward contract signatures, upsell revenue, or competitive displacement wins.

Payouts scale with deal size, often reaching $1,000-$5,000 for strategic accounts.

| Role | Typical Spiff Focus | Payout Range | Time Frame |

|---|---|---|---|

| SDR/BDR | Qualified meetings, new account sourcing | $25-$100 | Monthly |

| Account Executive | Closed deals, competitive wins, upsells | $500-$5,000 | Quarterly |

| Sales Leader | Team quota attainment, new market entry | $2,000-$10,000 | Quarterly/Annual |

The key difference: SDR spiffs focus on activity and pipeline generation, while AE spiffs emphasize revenue outcomes and strategic account wins. Both roles benefit when spiffs complement rather than replace their core sales development activities.

What Tools Help Manage Spiff Programs at Scale?

As sales teams grow, manual spiff tracking in spreadsheets becomes unmanageable. Modern sales organizations use integrated platforms that automate spiff calculation, provide real-time leaderboards, and ensure transparent payout processes.

Essential features for spiff management include:

- Automated tracking: Pull data directly from CRM systems to eliminate manual entry and disputes

- Real-time visibility: Show reps their current standing and progress toward spiff thresholds

- Rule engine flexibility: Configure complex eligibility criteria without custom development

- Audit trails: Maintain complete records of payouts, adjustments, and approvals for compliance

- Mobile access: Let reps check spiff status from anywhere, especially field sales teams

The consolidation trend is accelerating. Salesforce's $419 million acquisition of Spiff, Inc. in 2024 signals the industry's move toward unified sales performance platforms that handle everything from B2B prospecting to incentive compensation in one workspace.

Start Building a Holistic Sales Incentive Strategy in 2026

Spiffs work best as part of a comprehensive sales strategy that balances immediate results with long-term team development. The data is clear: organizations that integrate spiffs with broader performance management programs see 12X higher revenue growth than those relying on spiffs alone.

For Sales Leaders and RevOps teams managing incentive programs in 2026, the priority is consolidation. Stop juggling separate tools for prospecting, engagement, pipeline tracking, and incentive management.

Modern sales platforms unify these workflows, giving you complete visibility from first touch to closed deal to spiff payout.

As Cyera's team discovered after consolidating their tech stack: "Having everything in one system was a game changer." When your team can track spiff-eligible activities alongside pipeline health and forecast accuracy, you make smarter decisions about which incentives actually drive revenue.

Ready to unify your sales data and stop managing incentive programs in spreadsheets? Start free with Apollo and get 224M+ verified contacts, automated workflows, and complete pipeline visibility in one platform.

Prove Apollo's ROI In Your First 30 Days

Budget approval stuck on unclear metrics? Apollo delivers measurable pipeline impact from day one—track time saved, meetings booked, and revenue generated. Built-In increased win rates 10% and ACV 10% with Apollo's scoring.

Start Free with Apollo →Don't miss these

Sales

Inbound vs Outbound Marketing: Which Strategy Wins?

Sales

What Is a Sales Funnel? The Non-Linear Revenue Framework for 2026

Sales

What Is a Go-to-Market Strategy? The Data-Driven Blueprint That Actually Works

See Apollo in action

We'd love to show how Apollo can help you sell better.

By submitting this form, you will receive information, tips, and promotions from Apollo. To learn more, see our Privacy Statement.

4.7/5 based on 9,015 reviews