What Is Software Sales Salary in 2026? Roles, Regions, Compensation

What Is Software Sales Salary in 2026? Roles, Regions, Compensation

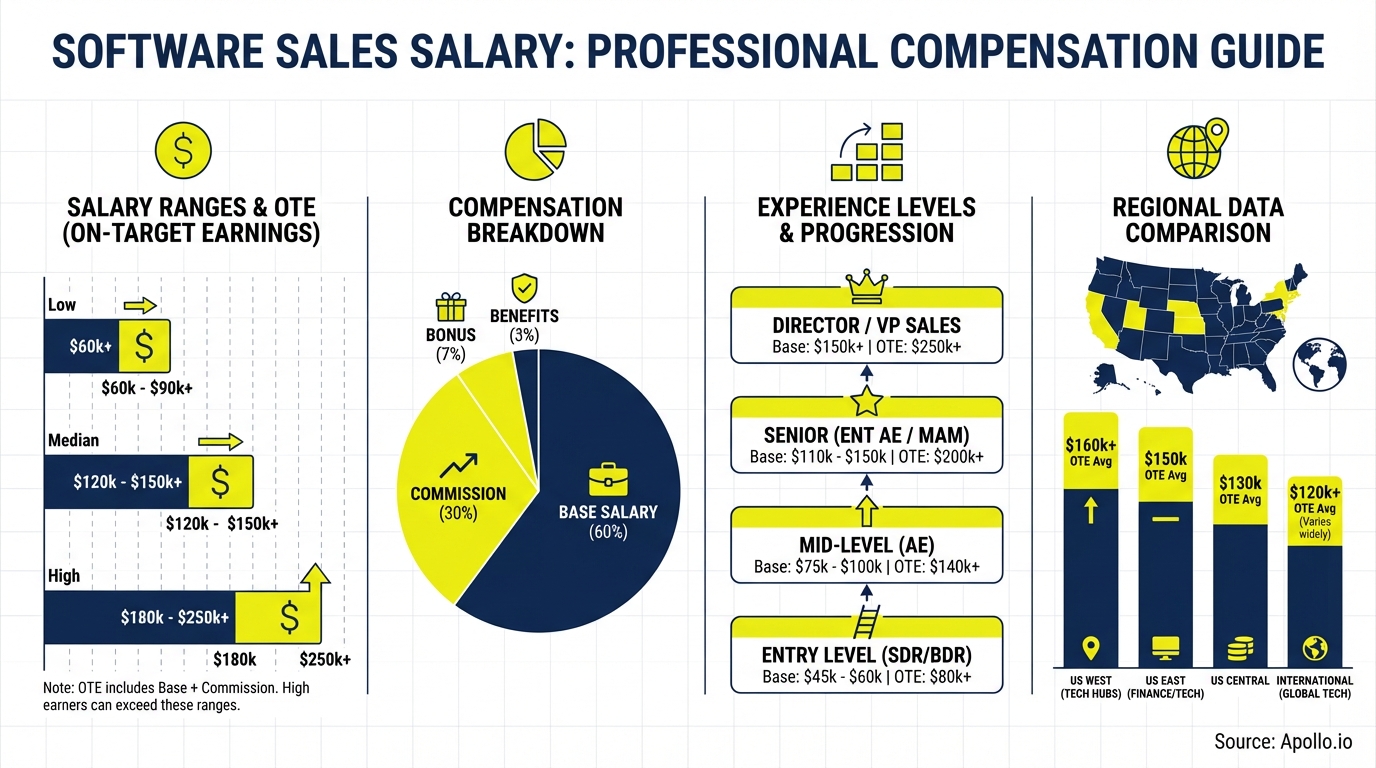

Software sales professionals in 2026 are earning more than ever, with enterprise sellers commanding six-figure packages and AI-focused roles pushing compensation even higher. According to the U.S. Bureau of Labor Statistics, the median annual wage for sales engineers in the software publishing industry reached $137,650 in May 2024. With Gartner forecasting worldwide IT spending to hit $5.74 trillion in 2025 (a 9.3% jump), demand for enterprise sales solutions expertise continues to surge.

Stop Manual Research—Apollo Finds Contacts Fast

Tired of spending 4+ hours daily hunting for contact info? Apollo delivers 224M+ verified contacts with 96% email accuracy so your team sells instead of searches. Join 550K+ companies closing more deals.

Start Free with Apollo →Key Takeaways

- Software sales salaries range from $65K-$150K base, with OTE reaching $250K-$500K+ for enterprise roles

- Regional variations are massive: San Francisco sellers earn 40-60% more than national averages due to cost of living

- AI-focused verticals (cybersecurity, cloud, GenAI tools) command 20-35% compensation premiums in 2026

- Commission structures evolved: accelerators kick in at 80-100% quota, uncapped earnings are now standard

- SDRs and BDRs hitting quota with modern tools report 30-50% faster career progression

What Are Software Sales Salary Ranges by Role in 2026?

Software sales compensation varies dramatically by role, experience, and territory. Entry-level SDRs start at $65K-$85K with OTE of $95K-$135K.

Mid-level Account Executives earn $90K-$130K base with $180K-$260K OTE. Enterprise sellers command $120K-$180K base with $250K-$500K+ total compensation.

| Role | Base Salary | OTE (On-Target Earnings) | Top Performers |

|---|---|---|---|

| SDR/BDR | $65K-$85K | $95K-$135K | $150K-$180K |

| Account Executive | $90K-$130K | $180K-$260K | $300K-$400K |

| Enterprise AE | $120K-$180K | $250K-$500K | $600K-$1M+ |

| Sales Engineer | $110K-$150K | $200K-$320K | $400K-$550K |

| Sales Manager | $130K-$170K | $220K-$350K | $450K-$650K |

For SDRs struggling to hit quota, prospecting inefficiency is often the culprit. Spending 4-6 hours daily on manual research kills productivity. Search Apollo's 224M+ contacts with 65+ filters to find ideal prospects in minutes. Teams using consolidated platforms report booking 35-50% more meetings per rep.

Turn Forecast Guesswork Into Revenue Certainty

Pipeline forecasting a guessing game? Apollo's real-time deal intelligence gives you accurate visibility across every stage. Built-In boosted win rates 10% with Apollo's scoring and signals.

Start Free with Apollo →How Do Regional Markets Impact Software Sales Compensation?

Geography dramatically affects software sales earnings. San Francisco and New York sellers earn 40-60% more than national averages, but cost-of-living adjustments reveal real purchasing power differences.

Remote roles now offer 85-95% of coastal salaries with significantly lower expenses.

| Region | AE Base Average | OTE Average | Cost-of-Living Adjusted |

|---|---|---|---|

| San Francisco Bay Area | $145K-$185K | $290K-$370K | $175K equivalent |

| New York City | $130K-$170K | $260K-$340K | $165K equivalent |

| Austin/Denver | $105K-$140K | $210K-$280K | $180K equivalent |

| Remote (National) | $95K-$135K | $190K-$270K | $190K+ equivalent |

Data from the Bureau of Labor Statistics shows software professionals in San Jose-Sunnyvale-Santa Clara earned $226,510 average annual salary in May 2024. However, remote Account Executives often achieve higher real income when housing costs are factored in.

What Compensation Models Work Best for Software Sales in 2026?

Modern software sales compensation combines base salary, variable commission, accelerators, and equity. The typical split is 50/50 or 60/40 (base to variable) for mid-market AEs, shifting to 40/60 or 30/70 for enterprise hunters.

Accelerators now kick in at 80-100% of quota rather than the old 100-120% thresholds.

Key compensation components:

- Base Salary: Fixed income covering living expenses, typically 40-60% of OTE

- Variable Commission: Percentage of closed revenue, usually 8-15% for new business

- Accelerators: Higher commission rates after hitting quota milestones (1.5x-2x at 120%+)

- SPIFs: Short-term incentives for strategic deals, product launches, or quarterly pushes

- Equity/RSUs: Stock options vesting over 3-4 years, common at high-growth startups

RevOps teams managing complex comp plans across multiple tools waste 15-20 hours monthly reconciling data. Consolidated platforms eliminate spreadsheet chaos and provide real-time visibility. Sales analytics systems that integrate directly with your CRM ensure accurate commission tracking and faster payouts.

How Do SDRs and BDRs Maximize Their Software Sales Earnings?

SDRs and BDRs maximize earnings by exceeding activity and meeting quotas consistently. Top performers book 25-35 qualified meetings monthly versus 12-18 for average reps.

The difference comes down to prospecting efficiency, messaging quality, and follow-up discipline.

Proven tactics for SDRs hitting 150%+ quota:

- Spend 60-70% of time on high-value outreach, not research or data entry

- Use AI sales automation for personalized sequences at scale

- Focus on accounts showing buying signals (tech stack changes, funding, hiring)

- Master social selling on LinkedIn for warm introductions

- Track metrics obsessively: connect rate, meeting show rate, SQL conversion

SDRs using modern prospecting platforms report 40-60% time savings on research. That extra time converts directly to more conversations and higher earnings.

Teams that consolidated from 3-5 tools into one workspace saw 35% faster rep ramp and 28% higher quota attainment.

What Industry Verticals Pay the Highest Software Sales Salaries?

Cybersecurity, cloud infrastructure, and AI/ML platforms lead software sales compensation in 2026. Enterprise AI tool sellers command 20-35% premiums over traditional SaaS roles due to deal complexity and strategic importance.

Vertical specialization increases earnings potential significantly.

| Vertical | AE OTE Range | Deal Size | Sales Cycle |

|---|---|---|---|

| Cybersecurity | $250K-$450K | $150K-$800K ACV | 4-9 months |

| Cloud Infrastructure | $230K-$420K | $200K-$1.2M ACV | 5-12 months |

| AI/ML Platforms | $270K-$500K+ | $180K-$900K ACV | 6-14 months |

| Martech/Sales Tools | $180K-$320K | $25K-$150K ACV | 2-5 months |

| DevOps/Collaboration | $200K-$360K | $50K-$300K ACV | 3-7 months |

Account Executives selling enterprise solutions in high-growth verticals leverage technical depth and consultative selling. They partner closely with sales engineers and often hold industry certifications (CISSP for security, AWS/Azure for cloud).

How Is AI Changing Software Sales Compensation in 2026?

AI is reshaping software sales comp structures by increasing deal velocity, expanding addressable markets, and creating new specialist roles. Companies selling AI-powered products pay 15-30% higher OTE because sellers need technical fluency and change management skills.

AI tools also help reps close more deals, raising average earnings across all experience levels.

AI's impact on compensation models:

- Faster sales cycles (30-40% reduction) allow reps to close more deals annually

- AI-assisted prospecting expands pipeline 2-3x without adding headcount

- Conversation intelligence surfaces coaching opportunities, accelerating skill development

- Automated workflows eliminate 15-20 hours of admin work weekly

Sales Leaders managing distributed teams need visibility into rep activities and deal health. Juggling multiple dashboards creates blind spots. Unified deal management platforms provide real-time pipeline insights and forecasting accuracy. Companies that consolidated their tech stack report 45% better forecast accuracy and 32% shorter sales cycles.

Start Maximizing Your Software Sales Earning Potential

Software sales offers unmatched earning potential in 2026, especially for professionals who master modern prospecting, leverage AI automation, and specialize in high-growth verticals. Whether you're an SDR aiming for six figures or an enterprise AE targeting $500K+, the path forward combines technical skills, strategic territory planning, and ruthless efficiency.

Top performers share common traits: they spend 70%+ of their time on revenue-generating activities, they use data to prioritize accounts, and they consolidate their workflow into integrated platforms. The difference between average and exceptional earnings often comes down to tools and processes, not just talent.

Ready to accelerate your sales career and hit quota more consistently? Schedule a Demo to see how Apollo's all-in-one platform helps sales professionals prospect smarter, engage faster, and close more deals.

Prove Apollo's ROI In 30 Days, Not 90

Budget approval stuck on unclear metrics? Apollo delivers measurable pipeline impact from day one—Built-In increased win rates 10% and ACV 10% using Apollo's signals. Get quantifiable ROI fast.

Start Free with Apollo →Don't miss these

Sales

Inbound vs Outbound Marketing: Which Strategy Wins?

Sales

What Is a Sales Funnel? The Non-Linear Revenue Framework for 2026

Sales

What Is a Go-to-Market Strategy? The Data-Driven Blueprint That Actually Works

See Apollo in action

We'd love to show how Apollo can help you sell better.

By submitting this form, you will receive information, tips, and promotions from Apollo. To learn more, see our Privacy Statement.

4.7/5 based on 9,015 reviews