Sales Reports: How to Turn Data Into Revenue Growth

Sales reports transform raw deal data into actionable insights that drive revenue growth. In 2026, B2B sales teams face unprecedented complexity: digital channels now generate over 56% of enterprise revenue, yet most organizations still cobble together data from 5+ disconnected tools. The right sales reporting framework cuts through this chaos, giving sales leaders, account executives, and RevOps teams the clarity they need to forecast accurately, identify bottlenecks, and coach reps to quota attainment.

Skip Manual Research—Apollo Finds Contacts Fast

Tired of spending 4+ hours daily hunting for contact info? Apollo delivers 224M verified contacts with 96% email accuracy instantly. Join 550K+ companies closing more deals.

Start Free with Apollo →Key Takeaways

- Modern sales reports integrate data from CRM, e-procurement, marketplace platforms, and traditional channels into unified dashboards

- AI-powered reporting delivers predictive insights, anomaly detection, and automated forecasting that improves accuracy by 35-40%

- Mobile-first dashboards enable real-time decision-making for field sales teams and remote Account Executives

- Digital sales channels (e-commerce, procurement platforms) require specialized metrics beyond traditional pipeline tracking

- Sales leaders using consolidated reporting platforms reduce tool costs by 40-60% while improving forecast accuracy

What Are Sales Reports?

Sales reports are structured documents or dashboards that track revenue performance, pipeline health, and team productivity across defined time periods. They answer critical questions: Are we on track to hit quota?

Which deals are at risk? Where should reps focus their time?

Effective sales reports consolidate data from multiple sources into a single view. According to McKinsey, e-commerce has become the leading sales channel in revenue generation and effectiveness among B2B organizations. This shift means sales reports in 2026 must track both traditional sales metrics and digital channel performance.

Core components include:

- Pipeline metrics: Deal stages, conversion rates, average deal size, sales cycle length

- Activity tracking: Calls made, emails sent, meetings booked, demos completed

- Revenue performance: Bookings, closed-won revenue, quota attainment by rep and team

- Channel attribution: Revenue by source (outbound, inbound, partner, marketplace, e-procurement)

- Forecast accuracy: Predicted vs. actual close rates, deal slippage analysis

Why Are Sales Reports Critical for Revenue Growth in 2026?

Sales reports provide the visibility sales leaders need to make data-driven decisions rather than relying on gut instinct. In an environment where U.S. B2B e-commerce sales reached $1.94 trillion in 2022 (a 19% increase year-over-year), tracking performance across all channels is no longer optional.

Key benefits for different roles:

- Sales Leaders: Identify underperforming reps early, allocate resources to high-value opportunities, and provide board-level revenue visibility

- Account Executives: Prioritize deals most likely to close, understand win/loss patterns, and optimize time allocation

- SDRs and BDRs: Track activity-to-opportunity conversion rates, identify best-performing outreach channels, and adjust tactics in real-time

- RevOps Teams: Maintain data hygiene, ensure CRM accuracy, eliminate reporting bottlenecks, and reduce tech stack complexity

Struggling with scattered data across multiple tools? Apollo's unified deal management platform consolidates pipeline tracking, activity metrics, and forecasting in one workspace, eliminating the need for separate reporting tools.

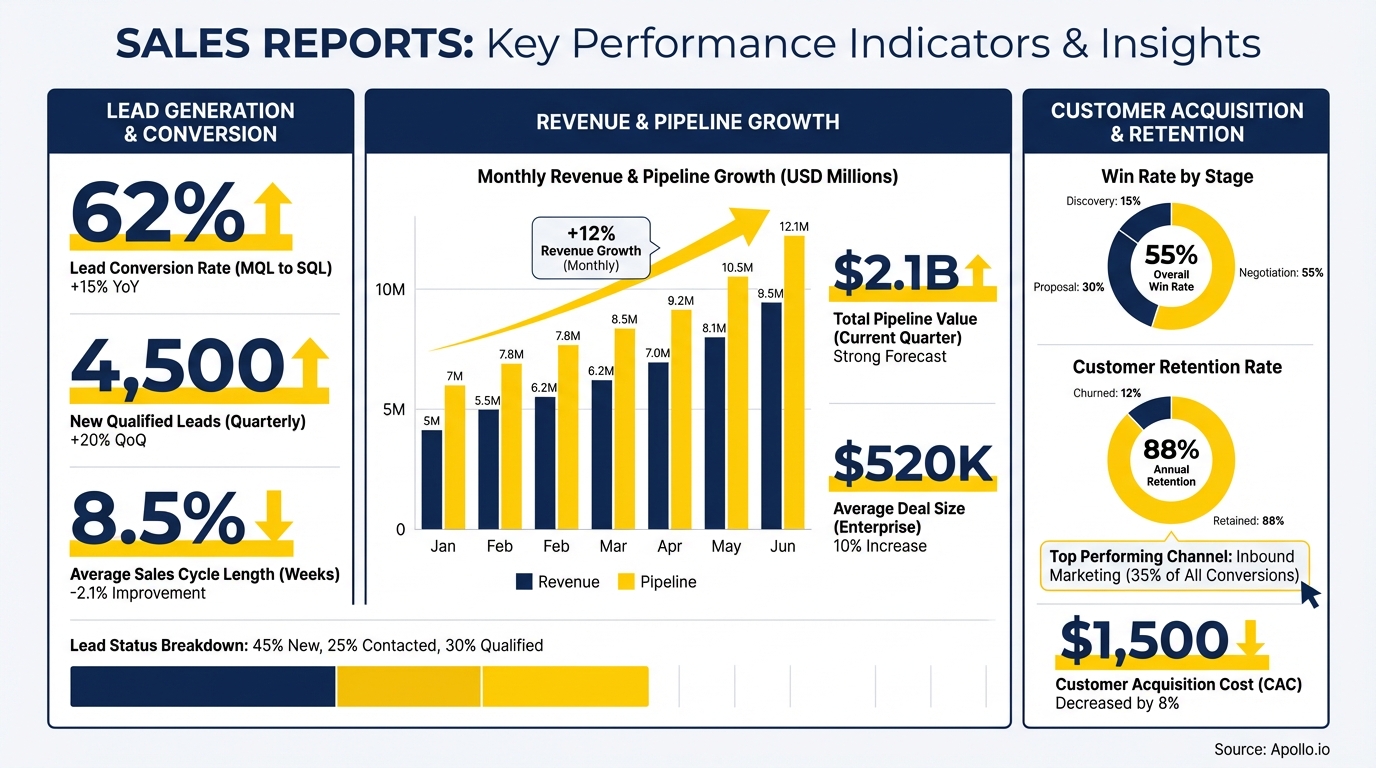

What Metrics Should Sales Leaders Track in 2026?

Modern sales reports track both traditional pipeline metrics and emerging digital channel KPIs. The specific metrics depend on your sales model, but here are the essentials:

| Metric Category | Key Metrics | Why It Matters |

|---|---|---|

| Pipeline Health | Pipeline coverage ratio, stage conversion rates, deal velocity | Predicts future revenue, identifies bottlenecks |

| Activity Metrics | Calls/emails per day, meeting-to-opportunity rate, response rates | Correlates rep behavior with outcomes |

| Revenue Performance | Bookings vs. quota, win rate, average contract value (ACV) | Measures actual results against targets |

| Channel Attribution | Revenue by source, channel ROI, digital vs. traditional split | Optimizes marketing and sales investment |

| Forecast Accuracy | Commit vs. actual, deal slippage rate, pipeline aging | Improves prediction reliability |

For teams selling through digital channels, add e-procurement metrics (order volume, average order value), marketplace performance (Amazon Business share, conversion rates), and self-service revenue. Data from Statista shows Amazon Business' market share in U.S. B2B e-commerce is forecasted to grow to 12.1% by 2025, up from 6.2% in 2020.

Turn Forecast Chaos Into Revenue Certainty

Pipeline forecasting a guessing game? Apollo's real-time deal tracking and AI-powered insights give you accurate forecasts that actually hold up. Built-In increased win rates 10% with Apollo's scoring and visibility.

Start Free with Apollo →How Do Sales Leaders Build AI-Powered Sales Reports?

AI transforms sales reporting from backward-looking dashboards into predictive intelligence systems. Modern platforms use machine learning to analyze historical patterns, identify at-risk deals, and recommend next-best actions.

Implementation steps:

- Consolidate data sources: Connect CRM, marketing automation, e-procurement systems, and marketplace platforms into a unified data warehouse

- Define predictive models: Train algorithms on historical win/loss data to score deal probability and forecast accuracy

- Automate anomaly detection: Set AI triggers to flag unusual patterns (sudden deal stalls, rep performance drops, pipeline gaps)

- Enable natural language queries: Allow sales leaders to ask questions like "Which deals are at risk this quarter?" and receive instant insights

- Build mobile dashboards: Ensure field reps and AEs can access real-time data from any device

AI-powered reporting delivers measurable results. Sales teams using AI tools report 35-46% increases in meeting bookings and deal closures. The key is starting with clean, unified data rather than layering AI on top of fragmented systems.

How Do RevOps Teams Integrate Multi-Channel Sales Data?

RevOps leaders face a critical challenge: combining traditional CRM data with e-procurement orders, marketplace sales, and self-service revenue into coherent reports. Most organizations fail because they treat each channel as a separate silo.

Best practices for multi-channel integration:

- Standardize identifiers: Use consistent customer IDs, account hierarchies, and product codes across all systems

- Implement data enrichment: Append firmographic and technographic data to both CRM contacts and e-procurement buyers

- Map channel touchpoints: Track the customer journey across outbound prospecting, inbound marketing, marketplace discovery, and procurement portals

- Unify attribution models: Credit revenue appropriately when deals involve multiple channels (e.g., SDR outreach followed by self-service purchase)

- Automate data sync: Use APIs and webhooks to ensure real-time updates rather than nightly batch processes

Organizations that successfully integrate multi-channel data report 25-30% improvements in forecast accuracy and 40-50% reductions in reporting preparation time. The alternative is maintaining separate dashboards for each channel, which creates blind spots and slows decision-making.

Tired of juggling disconnected reporting tools? Apollo's all-in-one GTM platform replaces 3-5 separate tools, giving you unified pipeline visibility, activity tracking, and forecasting in a single workspace. Census cut their costs in half, and Cyera reported that having everything in one system was a game changer.

What Are the Best Practices for Sales Report Design in 2026?

Effective sales reports balance comprehensiveness with usability. Too much data overwhelms users. Too little data hides critical insights. Here's how to strike the right balance:

Design principles:

- Role-based views: SDRs need activity metrics and pipeline generation. AEs need deal-stage visibility and close-date forecasts. Sales leaders need team rollups and variance analysis

- Mobile-first layouts: Design for phone screens first, then scale to tablets and desktops. Field sales teams check reports between meetings, not at desks

- Real-time updates: Eliminate manual refresh cycles. Data should update automatically as deals progress

- Drill-down capability: Start with executive summaries, then allow users to click through to transaction-level detail

- Actionable insights: Every chart should answer "So what?" and "What should I do next?"

Common mistakes to avoid:

- Using vanity metrics (total pipeline) instead of predictive metrics (weighted pipeline, conversion velocity)

- Building reports that require manual data entry or spreadsheet downloads

- Failing to segment by channel, product line, or customer segment

- Ignoring mobile optimization for remote and field sales teams

How Do Sales Reports Drive Team Performance and Coaching?

Sales reports become powerful coaching tools when they highlight performance gaps and best practices. Sales leaders can use report data to identify top performers, diagnose underperformance, and replicate winning behaviors across the team.

For SDRs and BDRs, compare activity levels (calls, emails, social touches) against conversion rates to find the optimal volume and messaging mix. High-performing SDRs typically maintain 60-80 activities per day with 15-20% email response rates.

For Account Executives, analyze win/loss patterns by deal size, industry, and sales cycle length. AEs who close larger deals often spend more time on discovery and less on generic demos.

Use report data to coach reps on qualification frameworks and value-based selling techniques.

For sales leaders, track forecast accuracy by rep. Reps who consistently overestimate deal probability need training on qualification criteria.

Those who sandbag deals create pipeline visibility problems. Regular forecast review meetings using shared reports build accountability and improve accuracy over time.

Ready to Transform Your Sales Reporting in 2026?

Modern sales reports integrate AI-powered insights, multi-channel data, and mobile-first design to give sales teams the visibility they need to hit revenue targets. The shift to digital channels makes unified reporting more critical than ever—organizations can no longer rely on CRM data alone.

Key implementation priorities:

- Consolidate your tech stack to reduce reporting complexity and improve data accuracy

- Implement AI-powered forecasting to identify at-risk deals and coach reps proactively

- Build role-specific dashboards that deliver actionable insights, not just data dumps

- Integrate e-procurement, marketplace, and traditional sales data into unified reports

- Optimize for mobile access so field teams and remote AEs can make real-time decisions

The organizations winning in 2026 treat sales reporting as a competitive advantage, not an administrative task. They invest in platforms that eliminate manual data wrangling and surface insights automatically.

Most importantly, they empower every team member—from SDRs to the CRO—with the data they need to make better decisions every day.

Start Your Free Trial and see how Apollo's unified GTM platform delivers real-time pipeline visibility, AI-powered forecasting, and mobile-optimized reporting in one workspace. Join 2M+ users and 550K+ companies who consolidated their sales tech stack and accelerated revenue growth.

Prove Apollo's ROI In Your First 30 Days

Budget approval stuck on unclear metrics? Apollo tracks every dollar—from contact to close. Built-In increased win rates 10% and ACV 10% with Apollo's scoring and visibility.

Start Free with Apollo →Don't miss these

Sales

Inbound vs Outbound Marketing: Which Strategy Wins?

Sales

What Is a Sales Funnel? The Non-Linear Revenue Framework for 2026

Sales

What Is a Go-to-Market Strategy? The Data-Driven Blueprint That Actually Works

See Apollo in action

We'd love to show how Apollo can help you sell better.

By submitting this form, you will receive information, tips, and promotions from Apollo. To learn more, see our Privacy Statement.

4.7/5 based on 9,015 reviews