OTE Meaning in Sales: How On-Target Earnings Work in 2026

OTE Meaning in Sales: How On-Target Earnings Work in 2026

Understanding OTE is critical for anyone evaluating sales roles in 2026. Sales professionals navigating job offers need clarity on compensation structures, while sales leaders designing incentive plans must balance motivation with business sustainability.

This article breaks down OTE meaning in sales, calculation methods, and how modern tools help teams hit their numbers consistently.

Apollo Eliminates 4+ Hours Of Daily Research

Tired of spending 4+ hours daily hunting for contact info? Apollo delivers 224M verified contacts with 96% email accuracy instantly. Join 550K+ companies who stopped manual prospecting.

Start Free with Apollo →Key Takeaways

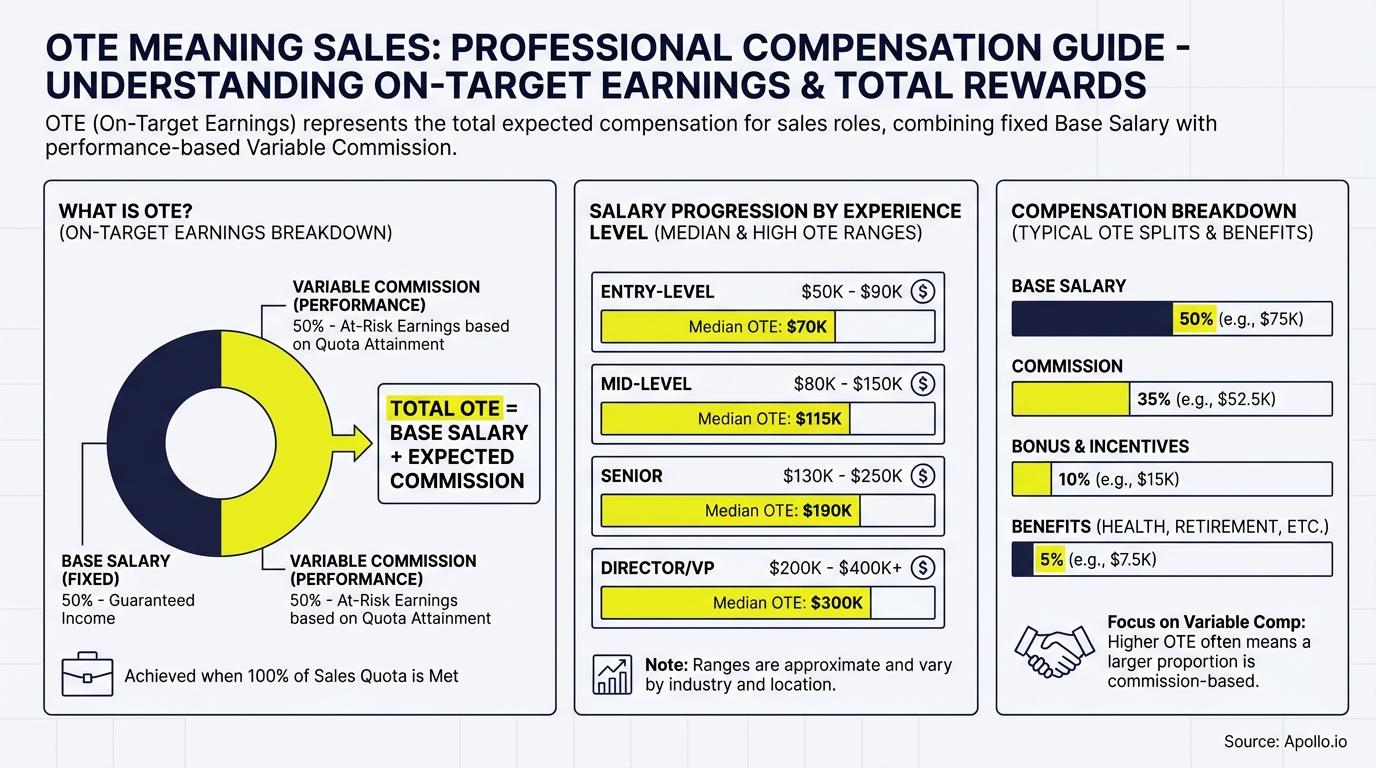

- OTE (On-Target Earnings) represents total compensation when sales reps hit 100% of quota, combining base salary plus commission

- Typical OTE splits range from 50/50 to 70/30 (base/variable), with AEs earning $120K-$180K OTE and SDRs earning $60K-$80K OTE in 2026

- AI-powered sales platforms help reps achieve OTE faster by automating prospecting and personalizing outreach at scale

- Realistic OTE structures align with market benchmarks and actual rep attainment rates (60-80% of reps hitting quota)

- Modern compensation plans integrate cross-channel performance metrics to reflect unified commerce buyer journeys

What Is OTE in Sales?

OTE (On-Target Earnings) is the total annual compensation a sales professional earns when achieving 100% of their quota. It combines base salary plus variable commission or bonuses.

If a sales role advertises $150K OTE with a 60/40 split, the rep receives $90K base salary and $60K in commission at quota.

OTE differs from base salary (guaranteed pay) and total compensation (which includes equity, benefits, and over-performance bonuses). Most B2B sales roles structure compensation around OTE because it aligns earnings with performance. Sales leaders use OTE to attract talent while managing payroll predictability.

The typical OTE range in 2026 varies by role. SDRs and BDRs earn $60K-$80K OTE.

Account Executives see $120K-$180K OTE. Enterprise AEs command $200K-$300K OTE.

Sales leaders and VPs earn $250K-$500K+ OTE depending on company size and industry.

How Is OTE Calculated in Sales Roles?

OTE calculation follows a simple formula: Base Salary + On-Target Commission = OTE. The base/variable split determines how much is guaranteed versus performance-based.

Common splits include 50/50, 60/40, 70/30, and 80/20.

Here's how different splits work with a $100K OTE:

| Split Ratio | Base Salary | Variable Commission | Risk Level |

|---|---|---|---|

| 50/50 | $50K | $50K | High risk, high reward |

| 60/40 | $60K | $40K | Balanced incentive |

| 70/30 | $70K | $30K | Lower risk, stable income |

| 80/20 | $80K | $20K | Minimal risk, less upside |

Commission structures vary by role and sales cycle length. SDRs typically earn per-meeting or per-qualified-lead bonuses.

AEs earn percentage-based commission on closed revenue. Enterprise roles often include accelerators (higher commission rates above 100% quota) and decelerators (lower rates below threshold).

Struggling to track deal progress and commission accurately? Manage your entire pipeline in Apollo with real-time visibility.

Turn Unreliable Forecasts Into Revenue Clarity

Forecasts feel like guesswork when deal data isn't real-time. Apollo tracks every stage with precision, so you forecast with confidence. Join 550K+ companies who stopped flying blind.

Start Free with Apollo →Why Does OTE Matter for Sales Professionals?

OTE provides transparent expectations for both candidates and employers. Sales professionals evaluating job offers compare OTE across companies to assess earning potential.

A $150K OTE role with 50/50 split requires more risk tolerance than a $150K role with 70/30 split.

Realistic OTE matters because inflated numbers mislead candidates. If a company advertises $200K OTE but only 20% of reps hit quota, actual earnings fall far short.

Smart candidates ask: What percentage of reps achieve 100% quota? What's the average attainment rate?

How long does it take new reps to ramp to full OTE?

For Account Executives managing complex deals, OTE structures should reflect deal cycle length and territory quality. Enterprise sales roles with 9-12 month cycles justify higher OTE but require patience during ramp periods. Transactional sales with 30-day cycles enable faster OTE achievement.

Research by AMA shows B2B buyers now consume 27% more content before purchasing, extending sales cycles. This trend forces companies to reassess OTE timelines and provide better enablement tools so reps hit quota despite longer buyer journeys.

How Do SDRs and AEs Achieve OTE Consistently?

Hitting OTE requires consistent activity, qualified pipeline, and efficient processes. SDRs must book enough meetings to earn their variable component.

AEs need sufficient pipeline coverage (typically 3-5x quota) to close enough deals.

Top-performing SDRs in 2026 use these strategies:

- Targeted prospecting: Research ideal customer profiles and focus on high-fit accounts rather than spray-and-pray outreach

- Multi-channel sequences: Combine email, LinkedIn, and phone across 8-12 touchpoints

- Personalization at scale: Use AI tools to customize messaging without sacrificing volume

- Fast follow-up: Contact inbound leads within 5 minutes to maximize conversion rates

AEs achieving OTE focus on pipeline velocity and deal qualification. They disqualify poor-fit prospects early, focus on decision-makers, and leverage sales analytics to identify winning patterns. According to The CMO Survey, companies with 100% online sales reported 13.4% revenue growth in 2025, highlighting how digital-first approaches accelerate deal closure.

Spending too much time on manual research and losing deals to faster competitors? Automate prospecting and outreach with Apollo's AI platform.

What Are Common OTE Mistakes Companies Make?

Companies designing OTE structures make predictable errors that demotivate teams. The most common mistake is setting unrealistic quotas that make OTE unattainable.

If only 30% of reps hit quota, the advertised OTE becomes meaningless.

Other critical mistakes include:

- Misaligned splits: Offering 50/50 splits for long sales cycles creates cash flow stress for reps during ramp periods

- Unclear accelerators: Complex commission structures confuse reps and reduce motivation

- No ramp period: Expecting full quota from day one sets new hires up for failure

- Ignoring market rates: Offering below-market OTE in competitive hiring environments leads to high turnover

- Changing comp plans mid-year: Frequent changes erode trust and create uncertainty

Sales leaders should benchmark OTE against industry standards and adjust for territory quality, product-market fit, and sales cycle complexity. RevOps teams play a critical role in modeling realistic quota attainment and ensuring compensation plans align with revenue goals.

How Does Technology Help Reps Achieve OTE Faster?

Modern sales platforms compress the time required to hit OTE by automating low-value tasks and surfacing high-intent prospects. AI-powered tools handle research, data enrichment, and initial outreach so reps focus on conversations and closing.

Key technology capabilities that accelerate OTE achievement:

- Intelligent prospecting: AI identifies best-fit accounts from 224M+ contacts using 65+ filters

- Automated sequences: Multi-channel campaigns run on autopilot with personalized messaging

- Real-time data enrichment: Contact info stays current with 96% email accuracy

- Pipeline visibility: Dashboards show deal health and forecast accuracy in real-time

- Conversation intelligence: AI call assistants capture notes and recommend next steps

Unified platforms eliminate the tech stack complexity that slows reps down. Teams using Apollo report consolidating 3-5 tools into one workspace, cutting costs while improving productivity.

As one customer noted: "We reduced the complexity of three tools into one" (Predictable Revenue).

For Founders and Sales Leaders building outbound motions, choosing the right sales tech stack directly impacts team quota attainment and OTE achievement rates.

Start Hitting Your OTE With the Right Tools

Understanding OTE is just the beginning. Achieving it consistently requires the right combination of strategy, process, and technology.

Sales professionals should evaluate OTE offers carefully, asking hard questions about quota attainment and ramp expectations. Sales leaders must design realistic compensation plans that motivate without misleading.

In 2026, the teams winning are those who combine clear OTE structures with powerful enablement tools. AI-powered platforms automate the busywork that prevents reps from hitting quota, while unified workspaces eliminate the friction of managing multiple disconnected tools.

Ready to hit your OTE faster and more consistently? Try Apollo Free and join 2M+ sales professionals using the all-in-one platform to prospect smarter, engage faster, and close more deals.

Prove Apollo's ROI In Your First 30 Days

Budget approval stuck on unclear metrics? Apollo tracks pipeline impact from day one—quantifiable time savings, deal velocity, and revenue growth. Customer. io achieved 50% YoY growth with measurable ROI.

Start Free with Apollo →

Andy McCotter-Bicknell

AI, Product Marketing | Apollo.io Insights

Andy leads Product Marketing for Apollo AI and created Healthy Competition, a newsletter and community for Competitive Intel practitioners. Before Apollo, he built Competitive Intel programs at ClickUp and ZoomInfo during their hypergrowth phases. These days he's focused on cutting through AI hype to find real differentiation, GTM strategy that actually connects to customer needs, and building community for product marketers to connect and share what's on their mind

Don't miss these

Sales

Inbound vs Outbound Marketing: Which Strategy Wins?

Sales

What Is a Sales Funnel? The Non-Linear Revenue Framework for 2026

Sales

What Is a Go-to-Market Strategy? The Data-Driven Blueprint That Actually Works

See Apollo in action

We'd love to show how Apollo can help you sell better.

By submitting this form, you will receive information, tips, and promotions from Apollo. To learn more, see our Privacy Statement.

4.7/5 based on 9,015 reviews