Industrial Sales: Strategies to Win B2B Deals in 2026

Industrial Sales: Strategies to Win B2B Deals in 2026

Industrial sales in 2026 looks nothing like it did five years ago. Buyers now research suppliers online, compare specs in self-service portals, and complete purchases without ever talking to a rep. According to Gartner, 61% of B2B buyers prefer a rep-free buying experience. For manufacturers, distributors, and enterprise sales teams, this shift demands new strategies, AI-powered tools, and unified platforms that eliminate the chaos of juggling multiple systems.

Apollo Eliminates 4+ Hours Of Daily Research

Tired of spending 4+ hours daily hunting for contact info? Apollo delivers 224M verified contacts with 96% email accuracy—so your team sells instead of searches. Join 550K+ companies closing more deals.

Start Free with Apollo →Key Takeaways

- Industrial sales teams must adopt AI and self-service channels to meet modern buyer expectations

- 61% of B2B buyers prefer digital self-service over traditional sales interactions

- Unified platforms cut tech stack complexity and costs while improving data accuracy

- Global markets like China offer massive growth opportunities for industrial sellers

- Sales enablement leaders using AI report 48% revenue increases and 51% shorter sales cycles

What Is Industrial Sales?

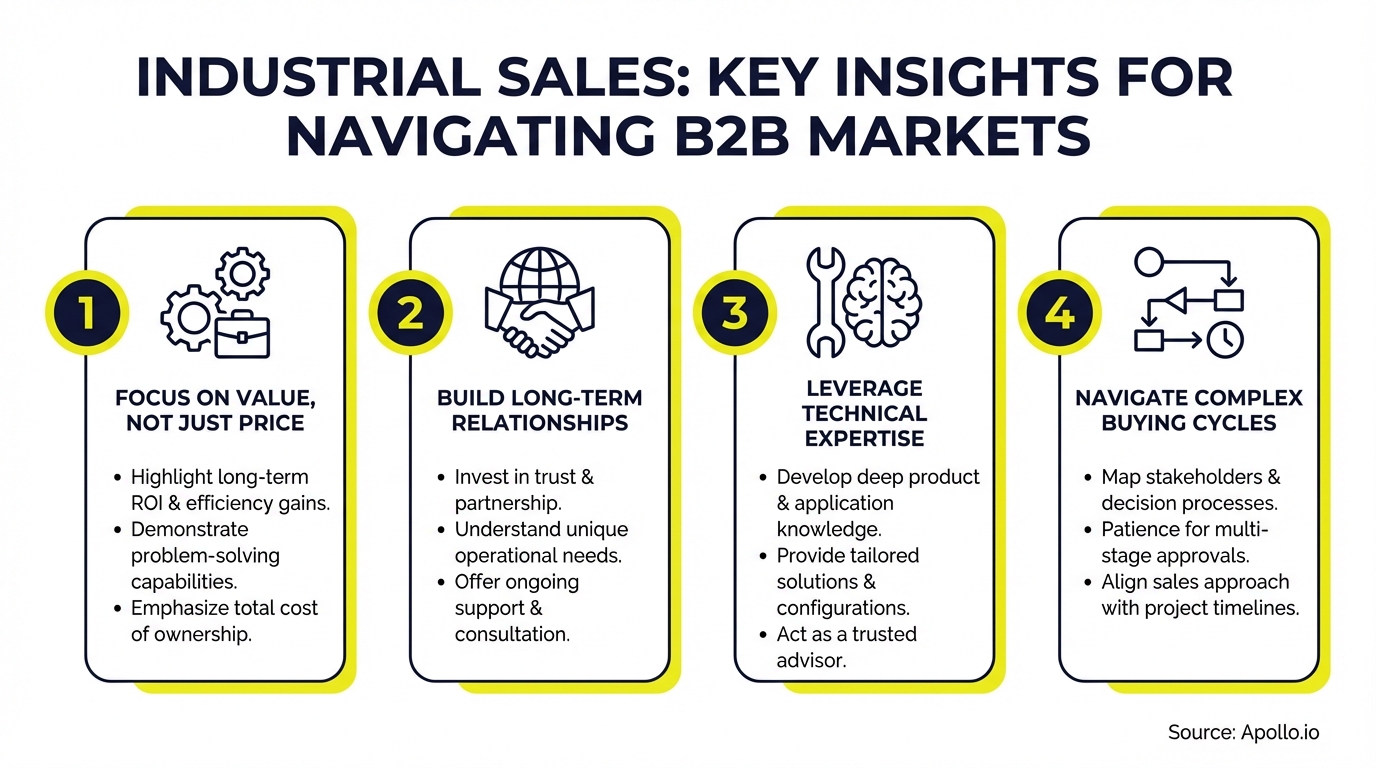

Industrial sales is the process of selling products, equipment, components, or services to businesses in manufacturing, distribution, construction, and heavy industry sectors. Unlike consumer sales, industrial sales involves complex buying committees, lengthy evaluation cycles, technical specifications, and high-value contracts.

Industrial sales professionals work with engineers, procurement teams, and executives to solve operational challenges with the right equipment, materials, or solutions.

The industrial sales process typically includes prospecting manufacturers and distributors, conducting technical needs assessments, providing product demonstrations, negotiating contracts, and managing ongoing relationships. Sales cycles range from weeks to months depending on purchase complexity. B2B sales organizations in industrial sectors face unique challenges: fragmented buyer journeys, demand for technical expertise, and pressure to demonstrate ROI before purchase decisions.

How Has Industrial Sales Changed in 2026?

Industrial sales has transformed dramatically due to digital acceleration and AI adoption. Research by E-commerce North America shows 100% of sales enablement leaders now use generative AI, with 48% reporting increased revenue and 51% experiencing shorter sales cycles. Buyers expect seamless digital experiences, self-service portals with real-time inventory, and personalized content before engaging sales reps.

Key shifts include:

- Digital-first buying: Buyers research products online, compare suppliers, and make decisions without sales contact

- AI-powered personalization: Sales teams use AI to analyze buyer behavior, personalize outreach, and predict purchase intent

- Self-service portals: Manufacturers provide online catalogs, pricing calculators, and ordering systems

- Shorter sales cycles: AI tools help sales reps prioritize high-intent accounts and automate follow-ups

Struggling to find qualified industrial buyers? Search Apollo's 224M+ contacts with 65+ filters for manufacturing decision-makers.

Why Do Industrial Sales Teams Need AI and Automation?

Industrial sales teams operate in high-complexity environments with long sales cycles, multiple stakeholders, and technical product specifications. AI and automation solve critical pain points: manual data entry, inconsistent follow-up, and limited visibility into buyer intent.

For SDRs prospecting manufacturers, AI research agents surface company signals like expansion plans, new facilities, or equipment upgrades. For Account Executives managing deals, AI assistants summarize calls, suggest next steps, and track buying committee engagement.

Automation benefits for industrial sales include:

- Faster lead qualification: AI scores accounts based on firmographics, technographics, and behavioral signals

- Personalized outreach at scale: AI generates customized emails referencing specific buyer challenges and industry trends

- Reduced administrative work: Automation handles meeting scheduling, CRM updates, and follow-up sequences

- Better forecasting: AI analyzes pipeline health and predicts deal close probability with higher accuracy

Sales Leaders report that AI sales automation platforms consolidate 3-5 separate tools into one workspace. Census, an Apollo customer, noted: "We cut our costs in half by moving from multiple tools to Apollo's unified platform."

Turn Forecast Guesswork Into Revenue Certainty

Pipeline forecasting a guessing game? Apollo delivers real-time deal visibility and intent signals so you forecast with confidence. Built-In increased win rates 10% using Apollo's scoring.

Start Free with Apollo →How Do Industrial Sales Reps Build Self-Service Buyer Experiences?

Self-service experiences start with comprehensive online product catalogs featuring detailed specifications, CAD drawings, inventory availability, and transparent pricing. Industrial buyers want to compare products, calculate total cost of ownership, and place orders independently.

Sales teams must ensure website content aligns with sales messaging to avoid buyer confusion and trust gaps.

Implementation steps:

- Audit content consistency: Compare website specs, brochures, and sales presentations for discrepancies

- Build self-service portals: Provide account-specific pricing, order history, and reorder functionality

- Enable configurators: Let buyers customize products and see pricing updates in real-time

- Integrate live chat: Offer instant technical support when buyers need human assistance

RevOps leaders find that unified platforms eliminate data silos between marketing websites, sales CRMs, and e-commerce systems. Cyera, another Apollo customer, stated: "Having everything in one system was a game changer for our team."

What Are the Best Strategies for Global Industrial Sales Growth?

Global expansion requires localized digital strategies, regional partnerships, and culturally adapted messaging. Data from B2B E-Commerce Association indicates China's B2B digital commerce reached $2.78 trillion, making it 1.7 times larger than the U.S. market. Industrial sellers targeting Asia-Pacific, Europe, or Latin America must adapt payment methods, logistics networks, and customer support to local expectations.

| Region | Key Considerations | Growth Opportunities |

|---|---|---|

| China | Local partnerships, Alibaba integration, Mandarin content | Manufacturing expansion, infrastructure projects |

| Europe | GDPR compliance, multi-language support, regional distributors | Green energy, automotive manufacturing |

| Latin America | Payment flexibility, logistics optimization, Spanish/Portuguese content | Mining, agriculture, construction |

Founders building global sales teams benefit from unified sales tech stacks that provide consistent data, workflows, and reporting across regions. Predictable Revenue reported: "We reduced the complexity of three tools into one with Apollo."

How Do Sales Leaders Measure Industrial Sales ROI?

Industrial sales ROI measurement focuses on deal velocity, win rates, average contract value, and customer lifetime value. Sales Leaders track metrics like pipeline coverage ratio (3:1 minimum), sales cycle length, and cost per acquisition.

AI-powered analytics platforms surface patterns: which buyer personas convert fastest, which outreach sequences drive meetings, and which deal stages cause bottlenecks.

Critical metrics for 2026:

- AI adoption impact: Revenue increase, cycle time reduction, rep productivity gains

- Self-service conversion: Portal usage rates, online order values, buyer satisfaction scores

- Tech stack efficiency: Tools eliminated, cost savings, data accuracy improvements

- Global expansion ROI: Regional revenue growth, market penetration rates, localization costs

Spending too much time tracking deals manually? Get complete pipeline visibility with Apollo's deal management and AI-powered forecasting.

Start Scaling Your Industrial Sales in 2026

Industrial sales success in 2026 requires embracing digital transformation, AI automation, and unified go-to-market platforms. The most successful teams consolidate their tech stacks, implement self-service buyer experiences, and use AI to personalize outreach at scale.

With 61% of buyers preferring rep-free experiences and 100% of sales leaders adopting AI, the competitive advantage goes to organizations that move fastest.

Whether you're an SDR prospecting manufacturers, an Account Executive closing multi-million dollar deals, or a Sales Leader building global teams, the right platform eliminates complexity and accelerates revenue. Apollo combines 224M+ verified business contacts, AI-powered research and messaging, multi-channel engagement, and deal management in one workspace.

No more juggling ZoomInfo for data, Outreach for sequences, Gong for call intelligence, and Salesforce for pipeline tracking.

Ready to cut your tech stack and scale industrial sales? Try Apollo Free and see why 550K+ companies trust Apollo for their go-to-market strategy.

Prove Apollo's ROI In Your First 30 Days

Budget approval stuck on unclear metrics? Apollo tracks every touchpoint from prospect to closed deal—quantifying time saved, pipeline built, and revenue won. Built-In increased win rates 10% and ACV 10% using Apollo's scoring and signals.

Start Free with Apollo →

Andy McCotter-Bicknell

AI, Product Marketing | Apollo.io Insights

Andy leads Product Marketing for Apollo AI and created Healthy Competition, a newsletter and community for Competitive Intel practitioners. Before Apollo, he built Competitive Intel programs at ClickUp and ZoomInfo during their hypergrowth phases. These days he's focused on cutting through AI hype to find real differentiation, GTM strategy that actually connects to customer needs, and building community for product marketers to connect and share what's on their mind

Don't miss these

Sales

Inbound vs Outbound Marketing: Which Strategy Wins?

Sales

What Is a Sales Funnel? The Non-Linear Revenue Framework for 2026

Sales

What Is a Go-to-Market Strategy? The Data-Driven Blueprint That Actually Works

See Apollo in action

We'd love to show how Apollo can help you sell better.

By submitting this form, you will receive information, tips, and promotions from Apollo. To learn more, see our Privacy Statement.

4.7/5 based on 9,015 reviews