Common Sales Objections and How to Overcome Them

Sales objections aren't rejection. They're buying signals disguised as resistance. According to Kondo, 75% of B2B buyers are taking longer to make purchase decisions now than in 2023. Longer cycles mean more objections, more stakeholders, and more internal friction before deals close. Understanding common sales objections helps SDRs, AEs, and sales leaders turn hesitation into momentum.

Apollo Cuts Research Time From Hours To Seconds

Tired of spending 4+ hours daily hunting for contact info? Apollo delivers 224M verified contacts with 96% email accuracy instantly. Join 550K+ companies who eliminated manual research.

Start Free with Apollo →Key Takeaways

- Most objections stem from internal buyer conflict, not lack of interest

- Pricing transparency and ROI clarity reduce budget objections by addressing CFO concerns early

- The biggest objection in 2026 is "no decision" as teams struggle to align internally

- Effective objection handling requires enablement content, not just rebuttals

- Multi-channel outreach with verified data reduces "not interested" objections significantly

What Are Common Sales Objections?

Common sales objections are predictable concerns prospects raise during the buying process. They fall into five categories: budget constraints, lack of urgency, trust issues, internal misalignment, and preference for the status quo.

These objections aren't roadblocks; they're information gaps you can fill with proof, transparency, and enablement assets.

Objections reveal what prospects need to move forward. A pricing objection signals they don't see clear ROI. A timing objection suggests they lack internal consensus or budget approval. Modern objection handling focuses on equipping buying committees with materials to sell internally, not just responding to individual pushback.

Why Are Sales Objections More Common in 2026?

B2B buying cycles are longer and involve more stakeholders. Research from Marketing LTB shows the average B2B sales cycle has increased to 4.9 months, up from 4.3 months in 2022. More time means more opportunities for objections to surface as deals move through procurement, legal, and executive review.

Buyers also conduct more research independently before engaging sellers. According to Mixology Digital, typical buyers do not reach out to sellers until they are 69% of the way through the buyer's journey. By the time SDRs connect, prospects have formed opinions, compared alternatives, and identified concerns they want addressed. This self-serve behavior shifts objections from early discovery calls to later evaluation stages.

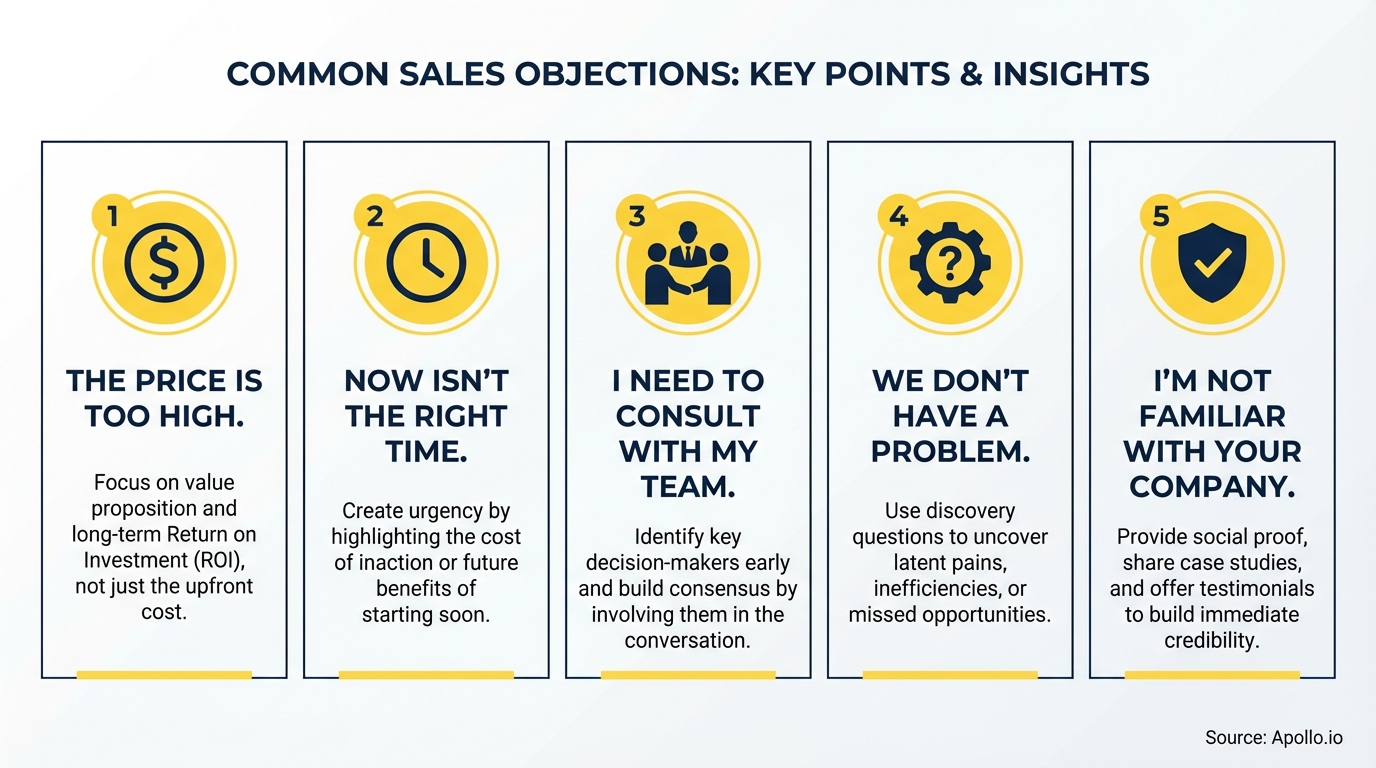

What Are the 5 Most Common Sales Objections?

These five objections appear across industries, deal sizes, and buyer personas. Each requires a distinct response strategy grounded in data, proof, and stakeholder enablement.

1. Budget and Pricing Objections

"It's too expensive" or "We don't have budget" signal prospects don't see ROI clarity or can't justify the investment to finance teams. Combat this with transparent pricing, total cost of ownership (TCO) breakdowns, and CFO-ready one-pagers showing cost savings versus current solutions or the cost of inaction.

2. Timing and Urgency Objections

"Not a priority right now" or "Call me next quarter" often mask internal misalignment or competing initiatives. Address timing objections by tying your solution to current business pain points, quantifying the cost of delay, and providing lightweight pilot or proof-of-concept options that reduce perceived risk.

3. Trust and Credibility Objections

"Never heard of you" or "Can you send references?" arise when prospects lack social proof or industry validation. Counter with case studies from similar companies, customer testimonials with specific outcomes, and analyst reports or third-party reviews that build credibility without requiring prospects to trust your claims alone.

4. Internal Alignment Objections

"Need to get buy-in from other stakeholders" or "Our team isn't aligned" reflect buying committee dysfunction.

Equip champions with stakeholder briefing templates, evaluation criteria worksheets, and risk mitigation documentation they can use to build internal consensus without your presence in every conversation.

5. Status Quo and No-Decision Objections

"We're happy with our current solution" or deals that stall indefinitely represent the biggest competitor in 2026. Research suggests decision paralysis kills more deals than competitor wins.

Overcome this by framing the cost of inaction, providing rollback plans that reduce perceived risk, and creating urgency through limited-time pilots or pricing incentives.

How Do SDRs and AEs Handle Objections Differently in 2026?

SDRs encounter objections during cold outreach and initial qualification. Their goal is securing a meeting, not closing a deal.

For SDRs, objection handling means demonstrating relevance quickly with personalized insights, referencing mutual connections or shared challenges, and offering low-commitment next steps like a 15-minute discovery call or sending a one-pager.

Struggling to personalize outreach at scale? Automate personalized sequences with Apollo's multi-channel engagement platform.

Account Executives face objections during deal evaluation and negotiation. AEs need to address detailed concerns about implementation, ROI, contract terms, and competitive positioning.

Their objection responses include detailed ROI calculators, implementation timelines, security documentation, and executive briefings. AEs also coordinate with champions to address objections from stakeholders they never speak with directly.

Fill Your Funnel With Sales-Ready Prospects

Struggling with low lead-to-opportunity conversion? Apollo identifies 224M prospects already showing buying intent. Built-In increased win rates 10% with better targeting.

Start Free with Apollo →What Content Helps Sales Teams Overcome Objections?

Enablement content turns objections into self-serve decision accelerators. Equip prospects with assets they can share internally to build consensus without requiring seller involvement in every conversation.

| Objection Type | Enablement Asset | Stakeholder Target |

|---|---|---|

| Budget/Pricing | TCO calculator, CFO one-pager, cost comparison | Finance, Procurement |

| Timing/Urgency | Cost of delay analysis, pilot proposal, quick-win roadmap | Executive sponsor, Operations |

| Trust/Credibility | Case studies, customer testimonials, analyst reports | End users, Technical evaluators |

| Internal Alignment | Stakeholder briefing template, evaluation criteria, RACI matrix | Champion, Cross-functional team |

| Status Quo | Risk assessment, rollback plan, competitive comparison | Risk management, Legal |

Sales leaders should create an objection-to-asset matrix that maps each common objection to 2-3 ready-to-send resources. This reduces rep prep time, ensures consistent messaging, and empowers champions to advocate internally. Tools like Apollo's unified sales platform centralize these assets for easy access during live conversations.

How Does Pricing Transparency Reduce Objections?

Buyers want pricing information earlier in the sales cycle, but many vendors hide it behind "contact sales" forms. This opacity creates friction and prolongs evaluation.

Publishing pricing ranges, explaining cost drivers, and providing self-service ROI calculators reduce budget objections by helping prospects self-qualify and build internal business cases before engaging sales.

Transparency doesn't mean listing exact prices for every configuration. It means providing enough information for buyers to understand whether your solution fits their budget range and what variables affect pricing.

Include example pricing scenarios, volume discount structures, and contract term options. This approach filters out unqualified prospects early while accelerating qualified deals through procurement.

Why Do Deals Stall With "No Decision" Objections?

The "no decision" objection happens when buying committees can't align internally or perceive the risk of change as higher than the risk of inaction. This objection doesn't surface in conversations; it manifests as ghosting, postponed meetings, and deals stuck in "evaluating" status for months.

Combat no-decision objections by reducing perceived risk. Offer pilot programs with clear success criteria and exit clauses.

Provide implementation roadmaps that show exactly what happens in weeks 1-12. Create rollback documentation explaining how prospects can revert to their current solution if outcomes don't meet expectations.

These materials make change feel less risky than the status quo.

Tired of deals stalling in your pipeline? Get complete pipeline visibility and deal tracking with Apollo.

Conclusion: Turn Objections Into Buying Momentum

Common sales objections in 2026 reflect longer buying cycles, complex stakeholder dynamics, and buyers' preference for self-serve research. The most effective response isn't better rebuttals; it's enablement content that helps champions sell internally.

Equip your team with objection-specific assets, pricing transparency, and risk-reduction materials that accelerate consensus.

Sales teams using data-driven prospecting, personalized outreach, and unified platforms report fewer "not interested" objections and faster deal cycles. Apollo consolidates prospecting, engagement, and pipeline management into one workspace, giving SDRs and AEs the context they need to address objections before they arise. Start building objection-proof workflows today. Schedule a Demo to see how Apollo helps teams turn objections into closed deals.

Prove Apollo's ROI In Your First 30 Days

Budget approval stuck on unclear metrics? Apollo tracks every touchpoint from prospect to pipeline—quantifiable time savings, measurable win rates, real revenue impact. Built-In increased win rates 10% and ACV 10%.

Start Free with Apollo →

Cam Thompson

Search & Paid | Apollo.io Insights

Cameron Thompson leads paid acquisition at Apollo.io, where he’s focused on scaling B2B growth through paid search, social, and performance marketing. With past roles at Novo, Greenlight, and Kabbage, he’s been in the trenches building growth engines that actually drive results. Outside the ad platforms, you’ll find him geeking out over conversion rates, Atlanta eats, and dad jokes.

Don't miss these

Sales

Inbound vs Outbound Marketing: Which Strategy Wins?

Sales

What Is a Sales Funnel? The Non-Linear Revenue Framework for 2026

Sales

What Is a Go-to-Market Strategy? The Data-Driven Blueprint That Actually Works

See Apollo in action

We'd love to show how Apollo can help you sell better.

By submitting this form, you will receive information, tips, and promotions from Apollo. To learn more, see our Privacy Statement.

4.7/5 based on 9,015 reviews