The Best B2B Sales Tools to Close More Deals in 2025

The Best B2B Sales Tools to Close More Deals in 2025

Modern B2B sales teams face a critical challenge: buyers now control the journey. Research from Accio shows that 80% of B2B sales interactions between suppliers and buyers now occur through digital channels. This shift demands sales tools that enable rep-free buying experiences while maintaining personalization at scale. The right B2B sales technology stack determines whether your team hits quota or struggles with disconnected workflows and incomplete data.

Prove Apollo's ROI In Your First 30 Days

Budget approval stuck on unclear metrics? Apollo delivers measurable pipeline impact from day one—track time saved, meetings booked, and revenue generated. Built-In increased win rates 10% and ACV 10% using Apollo's signals.

Start Free with Apollo →Key Takeaways

- Integration-first platforms consolidate 3-5 separate tools, cutting tech stack costs while improving data quality and workflow efficiency

- AI-powered sales automation now handles repetitive tasks like call summaries, research, and CRM updates, freeing reps to focus on relationship-building

- Unified sales intelligence platforms with verified contact data eliminate manual prospecting and enable multi-channel outreach from one workspace

- Modern B2B buyers expect self-service experiences backed by consistent messaging across all touchpoints

- Teams using integrated sales platforms report measurable improvements in pipeline coverage, conversion rates, and deal velocity

What Are B2B Sales Tools?

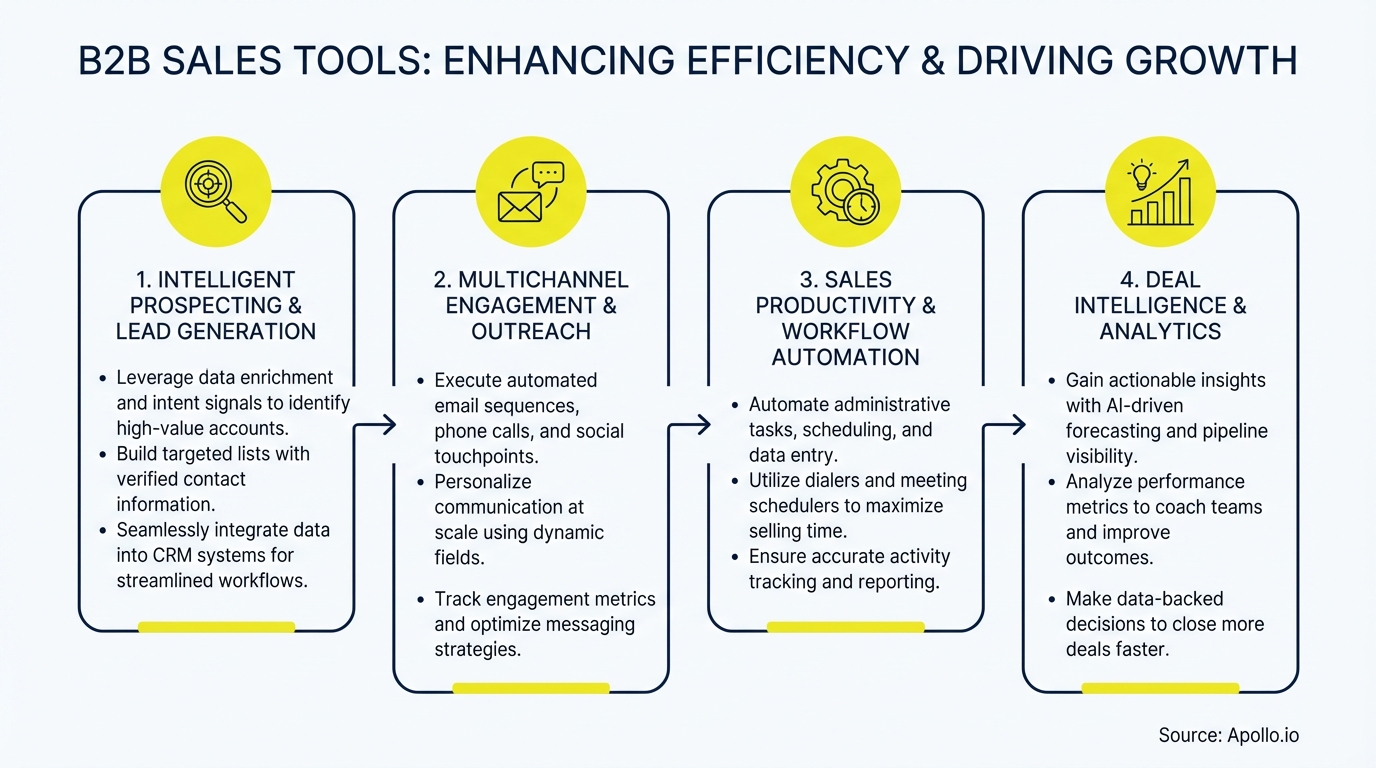

B2B sales tools are software platforms that help sales teams identify prospects, engage buyers, manage pipelines, and close deals in business-to-business transactions. These tools automate repetitive tasks, provide sales intelligence, and enable multi-channel outreach across email, phone, and social platforms.

Modern B2B sales technology has evolved from standalone point solutions into integrated platforms that unify prospecting, engagement, analytics, and AI automation.

According to Vena Solutions, 81% of sales teams are investing in some form of AI. The shift toward AI-powered workflows reflects a broader trend: sales organizations are consolidating their tech stacks. Instead of managing separate tools for data enrichment, email sequencing, call tracking, and CRM updates, leading teams now use unified platforms that handle multiple functions in one workspace. This consolidation addresses a core pain point—disconnected systems that create data silos and force reps to toggle between 5-7 different applications daily.

Why Do Sales Teams Need Integrated B2B Sales Tools?

Sales teams need integrated B2B sales tools because fragmented tech stacks create inefficiency, data inconsistencies, and longer sales cycles. When prospecting data lives in one system, engagement sequences in another, and deal tracking in a third, reps waste hours on manual data entry and context-switching.

Integrated platforms solve this by providing a single source of truth where contact data, interaction history, and deal status flow automatically across all functions.

The business case for integration is clear. Research from CloudApps found that hybrid sales teams have demonstrated up to 57% higher revenue growth than traditional face-to-face sales models. This growth stems from technology that enables consistent, scalable outreach across digital channels while maintaining relationship quality. For RevOps leaders managing sales technology, integration means fewer vendor contracts, simpler data governance, and one unified reporting system instead of stitching together metrics from multiple sources.

Customer outcomes validate this approach. "We reduced the complexity of three tools into one," reports Collin Stewart from Predictable Revenue. Census cut their costs in half by consolidating vendors, while Cyera found that "having everything in one system was a game changer" for their sales operations. Tired of managing multiple disconnected tools? Unify your GTM stack with Apollo's all-in-one platform.

How Do SDRs and BDRs Use Sales Tools to Book More Meetings?

SDRs and BDRs use sales tools to identify high-fit prospects, automate multi-channel outreach sequences, and track engagement signals that indicate buying intent. The most effective approach combines verified contact data with AI-powered personalization and automated follow-up cadences. Modern sales development teams focus on quality over volume, using intent data and behavioral signals to prioritize accounts showing active interest.

Here's how top-performing SDRs structure their workflow using integrated sales tools:

- Prospecting: Search databases with 65+ filters (job title, company size, technology stack, funding events) to build targeted account lists

- Enrichment: Automatically append verified emails, direct dials, and social profiles to contacts before outreach begins

- Sequencing: Launch multi-touch campaigns combining personalized emails, calls, and social touchpoints with AI-generated messaging

- Signal tracking: Monitor email opens, link clicks, and website visits to identify warm prospects ready for immediate follow-up

- Meeting booking: Use integrated calendar tools that let prospects self-schedule directly from email signatures or landing pages

The key advantage of unified platforms is context preservation. When an SDR sees a prospect opened three emails and visited the pricing page, that intelligence appears instantly in the dialer interface during calls. This real-time context enables more relevant conversations and higher conversion rates. Struggling to find qualified leads? Search Apollo's 224M contacts with 65+ filters.

What Sales Tools Do Account Executives Use to Close Deals Faster?

Account Executives use sales tools that provide pre-meeting intelligence, automate deal documentation, and track buying committee engagement across multiple stakeholders. The AE workflow differs from SDR prospecting—it requires deeper account insights, proposal automation, contract management, and revenue forecasting.

Effective AE tools integrate with the existing CRM while adding capabilities like conversation intelligence, competitive battle cards, and mutual action plan tracking.

For AEs managing complex enterprise deals, these capabilities matter most:

| Capability | Business Impact | Example Use Case |

|---|---|---|

| AI Call Assistant | Eliminates manual note-taking | Automatic summaries, action items, and CRM updates after every call |

| Deal Intelligence | Identifies at-risk opportunities | Alerts when stakeholder engagement drops or competitors enter evaluation |

| Buying Committee Mapping | Prevents single-threaded deals | Tracks which decision-makers are engaged vs. ignored |

| Pipeline Analytics | Forecasts revenue accuracy | Predicts close probability based on historical patterns and current activity |

The measurable outcome for AEs using integrated platforms is cycle-time reduction. When deal data, communication history, and next steps live in one system, AEs spend less time searching for information and more time advancing opportunities.

Sales leaders gain visibility into pipeline health without requiring manual updates from their teams.

Turn Weak Leads Into Sales-Ready Opportunities

Marketing leads falling flat at handoff. Apollo identifies prospects with verified intent signals and 96% email accuracy. Built-In boosted win rates 10% using Apollo's scoring.

Start Free with Apollo →How Do AI-Powered Sales Tools Improve Team Performance?

AI-powered sales tools improve team performance by automating time-consuming tasks, personalizing outreach at scale, and surfacing insights that human reps would miss in large datasets. According to Optif.ai, Gartner's 2025 Sales Technology Report indicates 89% of revenue organizations now use AI-powered tools, up from just 34% in 2023. This rapid adoption reflects proven ROI in specific use cases where AI demonstrably outperforms manual processes.

The most impactful AI applications in B2B sales include:

- Automated research: AI scans news, social posts, job changes, and funding announcements to identify trigger events for outreach timing

- Message generation: AI drafts personalized email copy based on prospect role, company, and industry while maintaining brand voice

- Call coaching: AI analyzes recorded calls to identify successful talk tracks, competitive objections, and areas where reps need training

- Lead scoring: AI predicts conversion likelihood based on firmographic data, engagement patterns, and historical win/loss analysis

- CRM hygiene: AI automatically updates contact records, logs activities, and enriches accounts without manual data entry

For sales leaders evaluating AI sales tools, the critical question is measurable impact. The best implementations show clear before/after metrics: response rates increased by X%, research time reduced by Y hours per week, or forecast accuracy improved by Z percentage points. Teams should pilot AI features with specific success criteria rather than adopting technology for its own sake.

What Should RevOps Leaders Consider When Building a Sales Tech Stack?

RevOps leaders should prioritize data governance, system integration, and vendor consolidation when building a sales tech stack. The goal is creating a unified architecture where customer data flows seamlessly between prospecting, engagement, analytics, and CRM systems without manual intervention.

Poor integration creates duplicate records, inconsistent reporting, and compliance risks that undermine the entire go-to-market operation.

A strategic sales tech stack evaluation framework includes:

| Evaluation Criteria | Why It Matters | Questions to Ask Vendors |

|---|---|---|

| Native CRM Integration | Eliminates data sync delays and errors | Does activity sync in real-time? Can we customize field mappings? |

| Data Accuracy SLAs | Reduces bounce rates and wasted outreach | What's your email deliverability rate? How often is data refreshed? |

| User Adoption Features | Drives consistent usage across teams | What training resources exist? How intuitive is the daily workflow? |

| Reporting Flexibility | Enables custom dashboards by role | Can we build custom reports? Export data for BI tools? |

| Compliance Controls | Mitigates legal and reputation risks | How do you handle opt-outs? What privacy certifications do you hold? |

The consolidation trend is accelerating. Organizations are using 2 fewer tools on average for GTM efforts versus last year, and 29% still rely on multiple disconnected systems.

RevOps leaders who successfully consolidate report fewer integration issues, lower total cost of ownership, and faster onboarding for new sales hires. The strategic advantage comes from having one platform that serves SDRs, AEs, and sales leaders rather than separate point solutions for each function.

How Does Apollo Consolidate Your B2B Sales Tool Stack?

Apollo consolidates your B2B sales tool stack by combining prospecting, engagement, enrichment, and analytics into one unified platform. Instead of paying for separate tools for contact data, email sequencing, call tracking, and CRM enrichment, teams using Apollo access 224M verified contacts, multi-channel sequences, an AI dialer, meeting scheduler, and deal management in a single workspace.

This integration eliminates the data silos and context-switching that slow down sales teams using fragmented tech stacks.

Here's what Apollo replaces in a typical B2B sales tech stack:

- Contact database vendors: 224M people across 30M+ companies with 96% email accuracy

- Sales engagement platforms: Multi-channel sequences combining email, calls, and social touchpoints

- Data enrichment services: Automatic contact and account enrichment with waterfall coverage

- Call tracking tools: Built-in dialer with local presence and AI-powered call summaries

- Meeting schedulers: Integrated calendar booking that syncs with your existing calendar

- Pipeline management: Deal tracking with forecasting and revenue analytics

Real customer outcomes validate this consolidation approach. "We reduced the complexity of three tools into one," says Collin Stewart from Predictable Revenue. Census reports cutting their costs in half by moving to Apollo, while Cyera found that "having everything in one system was a game changer." For founders and sales leaders, this consolidation means one contract instead of five, one onboarding process instead of multiple, and one source of truth for all sales data. See how other teams achieved similar results in these customer success stories.

Start Building Your Integrated B2B Sales Tech Stack

The shift toward integrated sales platforms reflects a fundamental change in how B2B teams operate. Buyers expect seamless digital experiences, sales reps need unified workflows, and RevOps leaders demand clean data governance.

Point solutions that excel at one function but fail to integrate create more problems than they solve. The winning approach combines verified data, AI-powered automation, and multi-channel engagement in one platform that serves SDRs, AEs, and sales leaders equally well.

For teams evaluating their current tech stack, ask three questions: How many tools do reps toggle between daily? Where does data duplication occur?

What percentage of rep time goes to administrative tasks versus selling? If the answers reveal inefficiency, consider consolidation.

The goal isn't adopting every new sales tool—it's building an integrated system that accelerates pipeline generation, shortens sales cycles, and improves forecast accuracy through better data and streamlined workflows.

Ready to consolidate your sales tech stack? Try Apollo Free and experience prospecting, engagement, and analytics in one unified platform.

Apollo Eliminates 4+ Hours Of Daily Research

Tired of spending 4+ hours daily hunting for contact info? Apollo delivers 224M verified contacts with 96% email accuracy instantly. Join 550K+ companies who stopped manual prospecting.

Start Free with Apollo →

Andy McCotter-Bicknell

AI, Product Marketing | Apollo.io Insights

Andy leads Product Marketing for Apollo AI and created Healthy Competition, a newsletter and community for Competitive Intel practitioners. Before Apollo, he built Competitive Intel programs at ClickUp and ZoomInfo during their hypergrowth phases. These days he's focused on cutting through AI hype to find real differentiation, GTM strategy that actually connects to customer needs, and building community for product marketers to connect and share what's on their mind

Don't miss these

Sales

Inbound vs Outbound Marketing: Which Strategy Wins?

Sales

What Is a Sales Funnel? The Non-Linear Revenue Framework for 2026

Sales

What Is a Go-to-Market Strategy? The Data-Driven Blueprint That Actually Works

See Apollo in action

We'd love to show how Apollo can help you sell better.

By submitting this form, you will receive information, tips, and promotions from Apollo. To learn more, see our Privacy Statement.

4.7/5 based on 9,015 reviews