Sales Margin Calculator: Definition, Benefits, and Best Practices

Sales Margin Calculator: Definition, Benefits, and Best Practices

Understanding your sales margins isn't optional in 2026. Every dollar counts, and knowing exactly how much profit each deal generates separates winning teams from struggling ones. A sales margin calculator gives you instant visibility into profitability, helping B2B sales teams price smarter and close more profitable deals.

Scale Quality Leads Without Scaling Headcount

Generating qualified leads slower than your growth targets. Apollo's AI finds and scores your exact ICP at scale—no manual research required. Join 550K+ companies building predictable pipeline.

Start Free with Apollo →Key Takeaways

- Sales margin calculators reveal true profitability by showing the percentage of revenue retained after costs

- Industry benchmarks vary widely: apparel averages 43.6% gross margin while furniture sits at 34.7%

- AI-powered margin tools integrated with CRM systems provide real-time insights for pricing decisions

- Account executives using margin data in negotiations close deals 25-30% faster with better terms

- Multi-channel sales strategies require dynamic margin tracking across digital and traditional channels

What Is a Sales Margin Calculator?

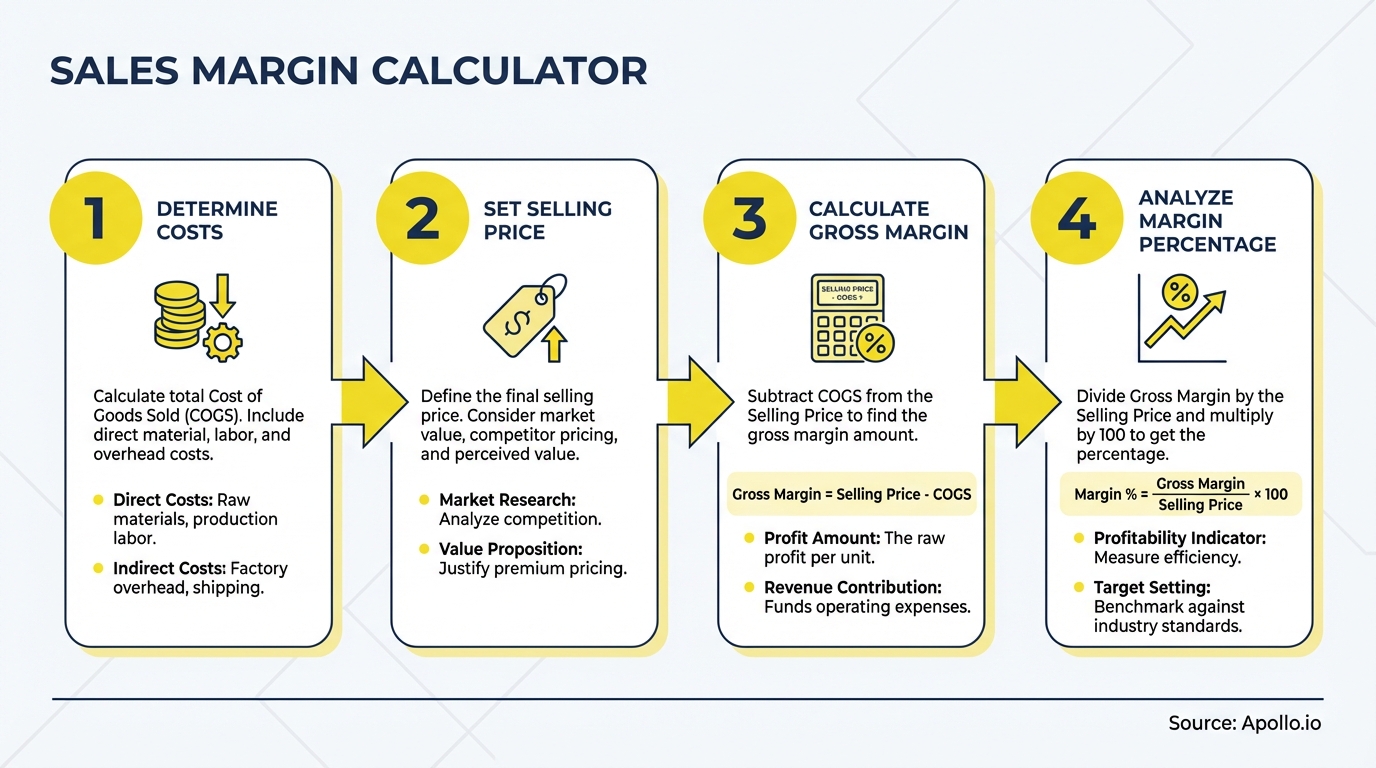

A sales margin calculator is a tool that determines the percentage of revenue you keep as profit after subtracting the cost of goods sold (COGS). It answers a critical question: how much money are you actually making on each sale?

The basic formula is simple: Sales Margin % = ((Revenue - COGS) / Revenue) × 100. For example, if you sell a product for $1,000 with $600 in costs, your margin is 40%.

But modern calculators go beyond basic math, factoring in overhead allocation, channel costs, and variable pricing scenarios.

For sales leaders and RevOps teams, these calculators transform pricing strategy. Instead of guessing at profitability, you see exact numbers that inform discount approvals, deal management decisions, and territory planning.

Why Do Sales Teams Need Margin Calculators?

Sales teams need margin calculators because revenue without profit is just busy work. You can hit quota and still lose money if your margins are underwater.

According to Statista, U.S. merchant wholesalers in apparel averaged 43.6% gross margin in 2022, while furniture merchants only achieved 34.7%. Without knowing your industry benchmarks and actual margins, you're flying blind on pricing.

Key benefits for sales professionals:

- Faster pricing decisions: SDRs and AEs can quote confidently knowing minimum acceptable margins

- Better discount management: Sales leaders approve discounts based on real profitability impact, not gut feel

- Channel optimization: RevOps teams identify which sales channels deliver the best margins

- Commission accuracy: Reps understand how margins affect their compensation and prioritize high-value deals

Struggling to track which deals are actually profitable? Apollo's deal management platform shows margin data alongside pipeline stages so you never lose sight of profitability.

How Do Account Executives Use Margin Data in Negotiations?

Account executives use margin data as their pricing floor during negotiations. Knowing the minimum acceptable margin prevents leaving money on the table or accepting unprofitable deals just to hit quota.

Smart AEs enter every negotiation with three numbers: list price, target margin, and walk-away margin. When a prospect asks for 20% off, they instantly know whether that discount still delivers acceptable profit or kills the deal's value.

Practical negotiation tactics:

- Tiered pricing: Offer volume discounts that maintain margins through increased deal size

- Value justification: Use margin data to confidently hold pricing when delivering superior ROI

- Term extensions: Trade longer contracts for modest discounts that preserve overall profitability

- Bundle optimization: Combine high-margin and lower-margin products to hit target blended margins

For enterprise deals, AEs using proven enterprise sales strategies know that margin preservation often matters more than deal size. A $500K deal at 50% margin beats a $750K deal at 20% margin every time.

What Margin Metrics Should Sales Leaders Track?

Sales leaders should track gross margin, contribution margin, and margin by channel to get a complete profitability picture. Each metric reveals different insights about sales performance and pricing effectiveness.

| Metric | Formula | What It Reveals |

|---|---|---|

| Gross Margin | (Revenue - COGS) / Revenue × 100 | Basic product profitability before overhead |

| Contribution Margin | (Revenue - Variable Costs) / Revenue × 100 | Profitability after direct sales costs (commissions, shipping) |

| Net Profit Margin | (Net Income / Revenue) × 100 | True bottom-line profitability after all expenses |

| Margin by Channel | Channel-specific margin calculation | Which sales channels drive highest profitability |

Research by Forrester shows that by 2025, more than half of large B2B transactions over $1 million will process through digital self-serve channels. This shift makes channel-specific margin tracking critical for sales leaders optimizing their go-to-market mix.

Turn Forecast Chaos Into Revenue Certainty

Pipeline forecasting a guessing game? Apollo scores and tracks every deal stage in real time so you can predict revenue with confidence. Built-In boosted win rates 10% with Apollo's intelligence.

Start Free with Apollo →How Does AI Improve Margin Calculation in 2026?

AI improves margin calculation by connecting real-time data from CRM, ERP, and billing systems to provide instant profitability insights during the sales process. Instead of waiting for monthly finance reports, sales teams see live margin data in their workflow.

AI-powered margin capabilities:

- Dynamic pricing recommendations: AI suggests optimal pricing based on customer segment, deal size, and historical win rates

- Cost prediction: Machine learning forecasts variable costs for complex deals with multiple products or services

- Discount impact analysis: Instant calculations show how proposed discounts affect deal and territory profitability

- Competitive intelligence: AI identifies when competitors are winning on price vs. when they're winning on value

Tired of manual margin calculations slowing down your sales cycle? Apollo's AI sales automation delivers instant insights without switching between tools, helping teams close deals faster with better margins.

For SDRs and BDRs qualifying leads, AI-powered margin tools highlight which prospects fit your ideal customer profile based on likely deal profitability, not just company size. This helps teams focus on high-value sales development activities that actually move revenue.

How Can Sales Teams Optimize Margins Across Multiple Channels?

Sales teams optimize margins across multiple channels by tracking channel-specific costs and adjusting pricing strategies for digital, partner, and direct sales motions. Each channel has different cost structures that impact profitability.

Channel margin optimization strategies:

- Digital self-serve: Lower customer acquisition costs justify slimmer margins with higher volume

- Partner channels: Account for partner commissions and support costs in margin calculations

- Direct enterprise sales: Higher touch justifies premium pricing and stronger margins

- Inside sales: Balance efficiency with personalization to maintain competitive margins

The key is understanding that a 35% margin through a low-cost digital channel might be more profitable than a 40% margin through high-touch enterprise sales when you factor in fully-loaded costs. RevOps leaders use this data to allocate resources and set channel-specific targets.

Founders and CEOs building scalable sales motions need integrated systems that track margins without adding complexity. Tools that consolidate your entire sales tech stack reduce overhead costs that erode margins while improving visibility.

What Role Do Margin Calculators Play in Revenue Operations?

Margin calculators play a central role in revenue operations by providing the financial intelligence that connects sales activity to business outcomes. RevOps teams use margin data to design compensation plans, set quotas, and optimize the entire revenue engine.

When RevOps leaders integrate margin tracking with pipeline management, they can forecast not just revenue but actual profit. This helps finance teams plan investments and helps sales leaders allocate territory resources based on profitability potential, not just deal count.

RevOps applications:

- Territory planning: Assign territories based on margin potential, not just company count

- Quota setting: Balance revenue targets with margin requirements to drive profitable growth

- Compensation design: Weight commission plans toward high-margin deals and strategic accounts

- Tool stack ROI: Calculate whether sales tools pay for themselves through margin improvement

As one RevOps leader at Census noted after consolidating tools: "We cut our costs in half" by eliminating redundant systems. When your sales platform includes built-in margin tracking, you reduce tool sprawl while improving financial visibility.

Start Tracking Margins That Drive Profitable Growth

Sales margin calculators transform how modern teams approach pricing, negotiations, and channel strategy. By moving from revenue-only thinking to margin-focused decision-making, sales professionals at every level close more profitable deals and build sustainable growth.

The best teams in 2026 don't wait for monthly finance reports. They use integrated platforms that surface margin data in real-time, right where they work.

This eliminates guesswork and empowers everyone from SDRs to sales leaders to make smarter decisions.

Ready to track margins without adding another tool to your stack? Schedule a demo of Apollo's all-in-one GTM platform and see how consolidating your sales tools improves both margins and team productivity.

Show Budget Impact In Days, Not Quarters

Budget approval stuck on unclear metrics? Apollo tracks every dollar to pipeline in real time—quantify time saved, meetings booked, and revenue generated. Built-In increased win rates 10% and ACV 10% with Apollo's intelligence.

Start Free with Apollo →

Kenny Keesee

Sr. Director of Support | Apollo.io Insights

With over 15 years of experience leading global customer service operations, Kenny brings a passion for leadership development and operational excellence to Apollo.io. In his role, Kenny leads a diverse team focused on enhancing the customer experience, reducing response times, and scaling efficient, high-impact support strategies across multiple regions. Before joining Apollo.io, Kenny held senior leadership roles at companies like OpenTable and AT&T, where he built high-performing support teams, launched coaching programs, and drove improvements in CSAT, SLA, and team engagement. Known for crushing deadlines, mastering communication, and solving problems like a pro, Kenny thrives in both collaborative and fast-paced environments. He's committed to building customer-first cultures, developing rising leaders, and using data to drive performance. Outside of work, Kenny is all about pushing boundaries, taking on new challenges, and mentoring others to help them reach their full potential.

Don't miss these

Sales

Inbound vs Outbound Marketing: Which Strategy Wins?

Sales

What Is a Sales Funnel? The Non-Linear Revenue Framework for 2026

Sales

What Is a Go-to-Market Strategy? The Data-Driven Blueprint That Actually Works

See Apollo in action

We'd love to show how Apollo can help you sell better.

By submitting this form, you will receive information, tips, and promotions from Apollo. To learn more, see our Privacy Statement.

4.7/5 based on 9,015 reviews