Gross vs Net Sales: Understanding the Critical Difference for Revenue Reporting

Gross vs Net Sales: Understanding the Critical Difference for Revenue Reporting

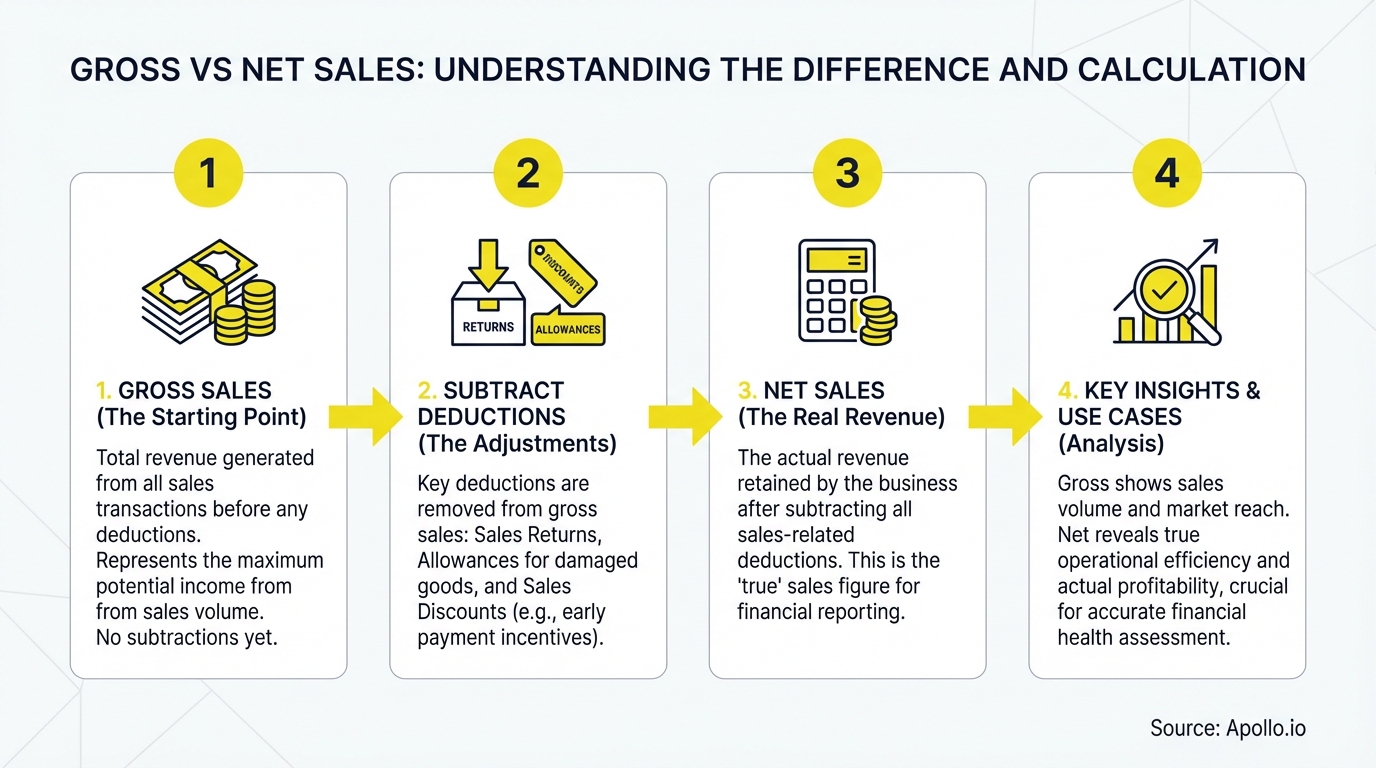

Sales teams and finance departments often struggle to reconcile revenue figures because they track different metrics. Gross sales shows total revenue before any deductions, while net sales reflects actual income after returns, discounts, and allowances. Understanding both metrics is critical for B2B sales organizations making strategic decisions in 2026's digital-first marketplace.

Apollo Eliminates 4+ Hours Of Daily Research

Tired of spending hours hunting for verified contact info? Apollo delivers 224M contacts with 96% email accuracy instantly. Join 550K+ companies who stopped manual prospecting.

Start Free with Apollo →Key Takeaways

- Gross sales represents total revenue before any deductions, while net sales shows actual income after returns, discounts, and allowances

- B2B digital channels now account for 56% of revenue, making accurate gross vs net tracking essential for multi-channel operations

- RevOps teams use net sales for realistic forecasting and budgeting, while gross sales helps measure overall market demand

- ASC 606 revenue recognition standards require specific gross vs net treatment for digital subscriptions and cross-border transactions

- Sales leaders tracking both metrics gain visibility into discount effectiveness, return patterns, and actual revenue performance

What Is Gross Sales?

Gross sales is the total revenue from all sales transactions before any deductions, discounts, returns, or allowances. It represents the maximum potential income from your sales activities.

For B2B companies, gross sales includes all invoiced amounts regardless of whether customers claim discounts or return products. A software company with $500,000 in contracts signed during Q1 records $500,000 in gross sales, even if some customers negotiate payment terms or early-bird discounts.

Components of gross sales:

- All invoice totals at list price

- Upsells and cross-sells at full value

- Contract renewals before discount application

- Multi-year deals at total contract value

Sales leaders use gross sales to measure team performance and market demand. Enterprise sales teams often set quotas based on gross sales figures because they reflect total selling effort before customer negotiations.

What Is Net Sales?

Net sales is the actual revenue a company earns after subtracting returns, allowances, and discounts from gross sales. This metric shows real income available for operations and growth.

The formula is straightforward: Net Sales = Gross Sales - Returns - Allowances - Discounts. A company with $500,000 in gross sales, $25,000 in returns, $15,000 in allowances, and $35,000 in discounts reports $425,000 in net sales.

Common deductions from gross sales:

- Early payment discounts (2/10 net 30 terms)

- Volume-based pricing adjustments

- Product returns and refunds

- Damaged goods allowances

- Promotional pricing reductions

RevOps teams rely on net sales for financial planning because it represents actual cash flow. According to Statista research, 56% of B2B revenue now flows through digital channels where discount structures and return policies significantly impact net sales calculations.

Why Do Sales Leaders Track Both Metrics?

Sales leaders need both gross and net sales because each metric reveals different aspects of business performance. Tracking only one creates blind spots in revenue analysis.

Gross sales shows market demand and sales team effectiveness at closing deals. Net sales reveals profitability and pricing strategy success.

The gap between them exposes discount dependency and return rate problems.

| Metric | Best Use Case | Who Tracks It |

|---|---|---|

| Gross Sales | Sales quotas, market demand analysis, team performance | Sales Leaders, SDRs, AEs |

| Net Sales | Financial planning, budgeting, profitability analysis | RevOps, Finance, Executives |

| Variance Analysis | Discount effectiveness, return pattern identification | Sales Operations, Product Teams |

Can't see the full revenue picture across your pipeline? Track deals from first touch to close with Apollo's unified deal management platform.

Turn Forecasting Guesswork Into Revenue Certainty

Pipeline forecasting a guessing game? Apollo delivers real-time deal visibility and intent signals that make quota predictable. Built-In boosted win rates 10% with Apollo's buying signals.

Start Free with Apollo →How Do Digital Channels Affect Gross vs Net Sales Calculations?

Digital B2B channels introduce complexity to gross vs net calculations through self-service pricing, multi-tier discounts, and automated return processes. Data from Gartner shows 61% of B2B buyers prefer rep-free purchasing, creating new deduction scenarios.

Digital-specific deductions impacting net sales:

- Self-service discount codes applied at checkout

- Dynamic pricing based on customer segment

- Automated volume-tier adjustments

- Trial-to-paid conversion credits

- Subscription downgrades within billing period

For Account Executives managing enterprise accounts, digital channels create revenue recognition challenges. A customer might sign a $100,000 annual contract (gross sales) but immediately apply a 20% enterprise discount plus a $5,000 implementation credit, reducing net sales to $75,000.

What Are the Revenue Recognition Implications Under ASC 606?

ASC 606 revenue recognition standards require companies to report revenue at the transaction price customers actually pay, making net sales the primary metric for financial reporting. This impacts how B2B companies record digital subscriptions and multi-year contracts.

Key ASC 606 considerations for gross vs net:

- Variable consideration must be estimated and deducted upfront

- Expected returns reduce recognized revenue at sale time

- Volume rebates require constraint analysis

- Stand-alone selling price determines discount allocation

RevOps teams must align sales analytics systems with accounting standards. A SaaS company offering annual subscriptions with quarterly payment options and volume discounts needs systems that automatically calculate net sales at contract inception, not just track gross bookings.

How Can Sales Teams Improve Net Sales Performance?

Sales teams improve net sales by reducing unnecessary discounting, minimizing returns, and optimizing pricing strategies. The goal is narrowing the gap between gross and net sales without sacrificing deal velocity.

Proven strategies for maximizing net sales:

- Implement discount approval workflows for deals over 15%

- Train AEs on value-based selling to reduce price objections

- Analyze return patterns to identify product-market fit issues

- Create tiered pricing that captures value without heavy discounting

- Use data enrichment to target high-fit prospects who need less convincing

Struggling to identify prospects who convert without heavy discounts? Search Apollo's 224M+ verified contacts with 65+ filters to find your ideal customer profile.

Sales leaders at companies like Census report cutting costs in half by consolidating their tech stack into unified platforms. Using integrated sales tools eliminates data silos that hide the true relationship between gross bookings and actual revenue.

Start Tracking Revenue That Actually Matters

Understanding gross vs net sales is foundational for any B2B sales organization in 2026. Gross sales measures market demand and team performance, while net sales reveals actual profitability and cash flow.

Sales leaders who track both metrics gain complete visibility into discount effectiveness, return patterns, and real revenue performance.

Digital channels and ASC 606 standards make accurate tracking more complex but more critical. RevOps teams need unified systems that automatically calculate deductions, track multi-channel transactions, and align with revenue recognition requirements.

The companies that master this balance build predictable, profitable growth.

Ready to unify your revenue data across every channel and touchpoint? Get Leads Now with Apollo's all-in-one platform trusted by 550K+ companies.

Prove Apollo's ROI In Your First 30 Days

Budget approvals stuck on unclear metrics? Apollo tracks every touchpoint from prospect to closed deal, quantifying exactly how much pipeline you're generating. Built-In increased win rates 10% and ACV 10% with measurable signals.

Start Free with Apollo →

Kenny Keesee

Sr. Director of Support | Apollo.io Insights

With over 15 years of experience leading global customer service operations, Kenny brings a passion for leadership development and operational excellence to Apollo.io. In his role, Kenny leads a diverse team focused on enhancing the customer experience, reducing response times, and scaling efficient, high-impact support strategies across multiple regions. Before joining Apollo.io, Kenny held senior leadership roles at companies like OpenTable and AT&T, where he built high-performing support teams, launched coaching programs, and drove improvements in CSAT, SLA, and team engagement. Known for crushing deadlines, mastering communication, and solving problems like a pro, Kenny thrives in both collaborative and fast-paced environments. He's committed to building customer-first cultures, developing rising leaders, and using data to drive performance. Outside of work, Kenny is all about pushing boundaries, taking on new challenges, and mentoring others to help them reach their full potential.

Don't miss these

Sales

Inbound vs Outbound Marketing: Which Strategy Wins?

Sales

What Is a Sales Funnel? The Non-Linear Revenue Framework for 2026

Sales

What Is a Go-to-Market Strategy? The Data-Driven Blueprint That Actually Works

See Apollo in action

We'd love to show how Apollo can help you sell better.

By submitting this form, you will receive information, tips, and promotions from Apollo. To learn more, see our Privacy Statement.

4.7/5 based on 9,015 reviews